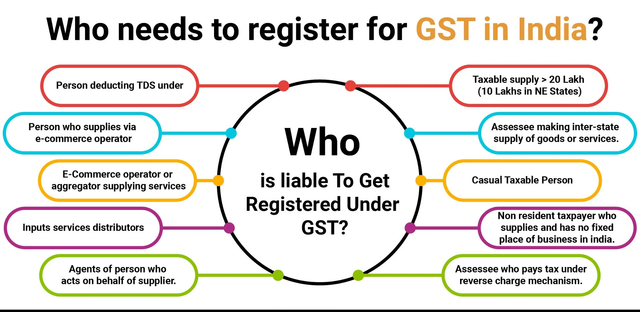

9.14 What is tax registration number in India?

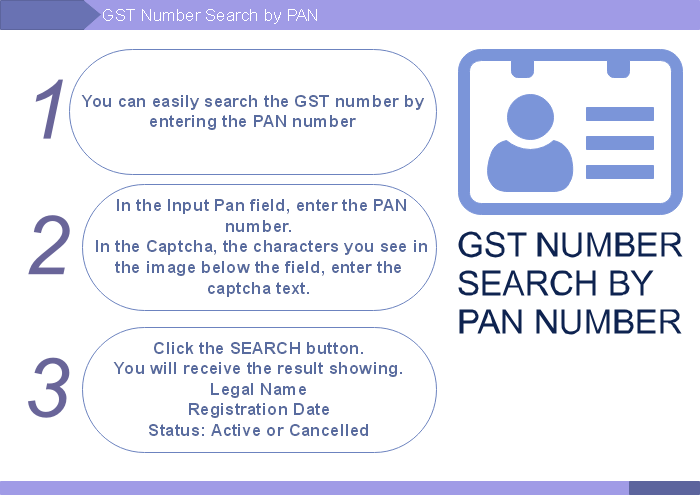

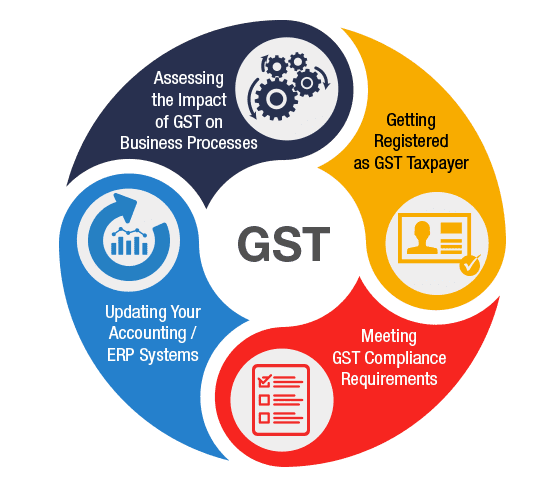

Tax registration number Tax registration number: To acquire the PAN (Permanent Account Number) using a GST (Goods and Services Tax) number in India, please adhere to the subsequent instructions: Visit the official GST portal: Go to the Goods and Services Tax (GST) portal website of India at www.gst.gov.in. Click on “Search Taxpayer”: On… Read More »