Goods and Services Tax (GST)

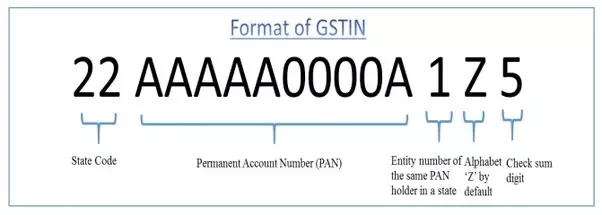

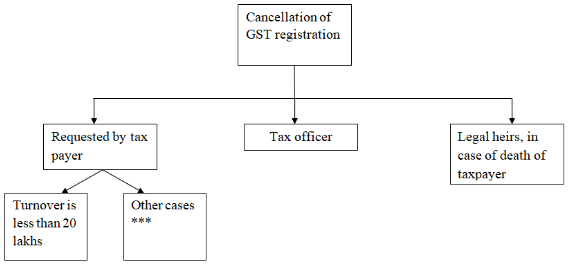

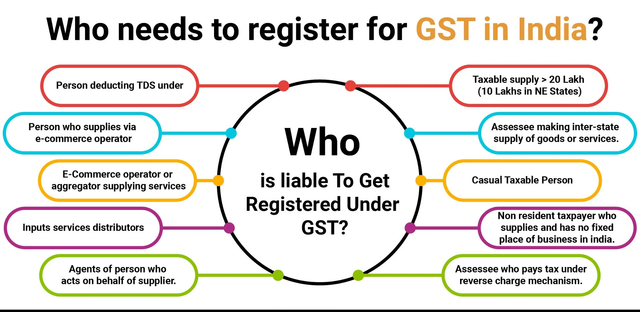

Goods and Services Tax (GST) Goods and Services Tax (GST): The GST is a comprehensive indirect taxation system imposed on the provision of goods and services across India. It is a destination-base tax system that aims to replace multiple indirect taxes like excise duty, service tax, VAT (Value Added Tax), and others. 1. Introduction: GST… Read More »