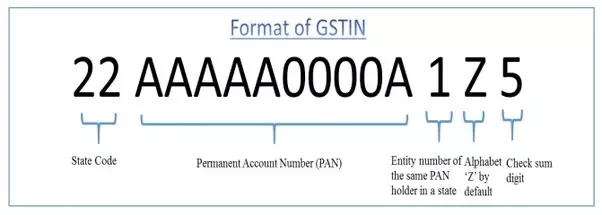

Q 9.20 Finding PAN in GSTIN: where is pan number in gst number?

Finding PAN in GSTIN Website Link: Finding PAN in GSTIN: The PAN (Permanent Account Number) is not directly embedded within the GST (Goods and Services Tax) number. However, the PAN number is used as a basis for generating the GSTIN (GST Identification Number). In the GSTIN, the PAN number is included as part of the… Read More »