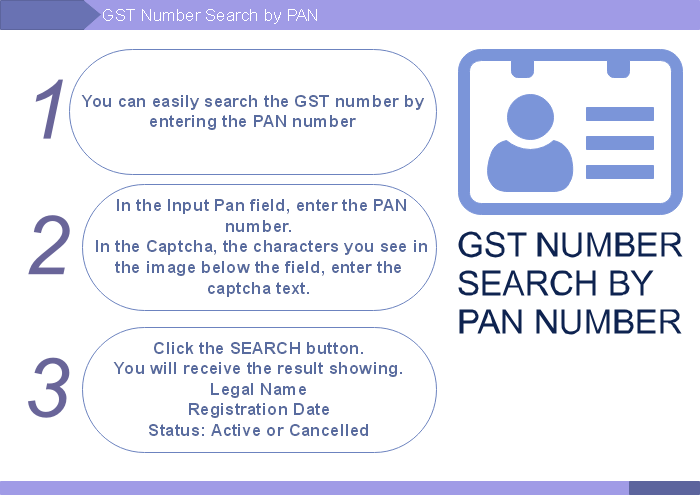

why gst registration is important?

GST Registration Importance GST (Goods and Services Tax) registration is importance for several reasons: Legal Compliance: GST registration is a legal requirement for businesses that meet the turnover threshold specified by the government. Failing to comply with the GST registration requirements can lead to fines and legal ramifications. Legitimate Business Operations: GST registration… Read More »