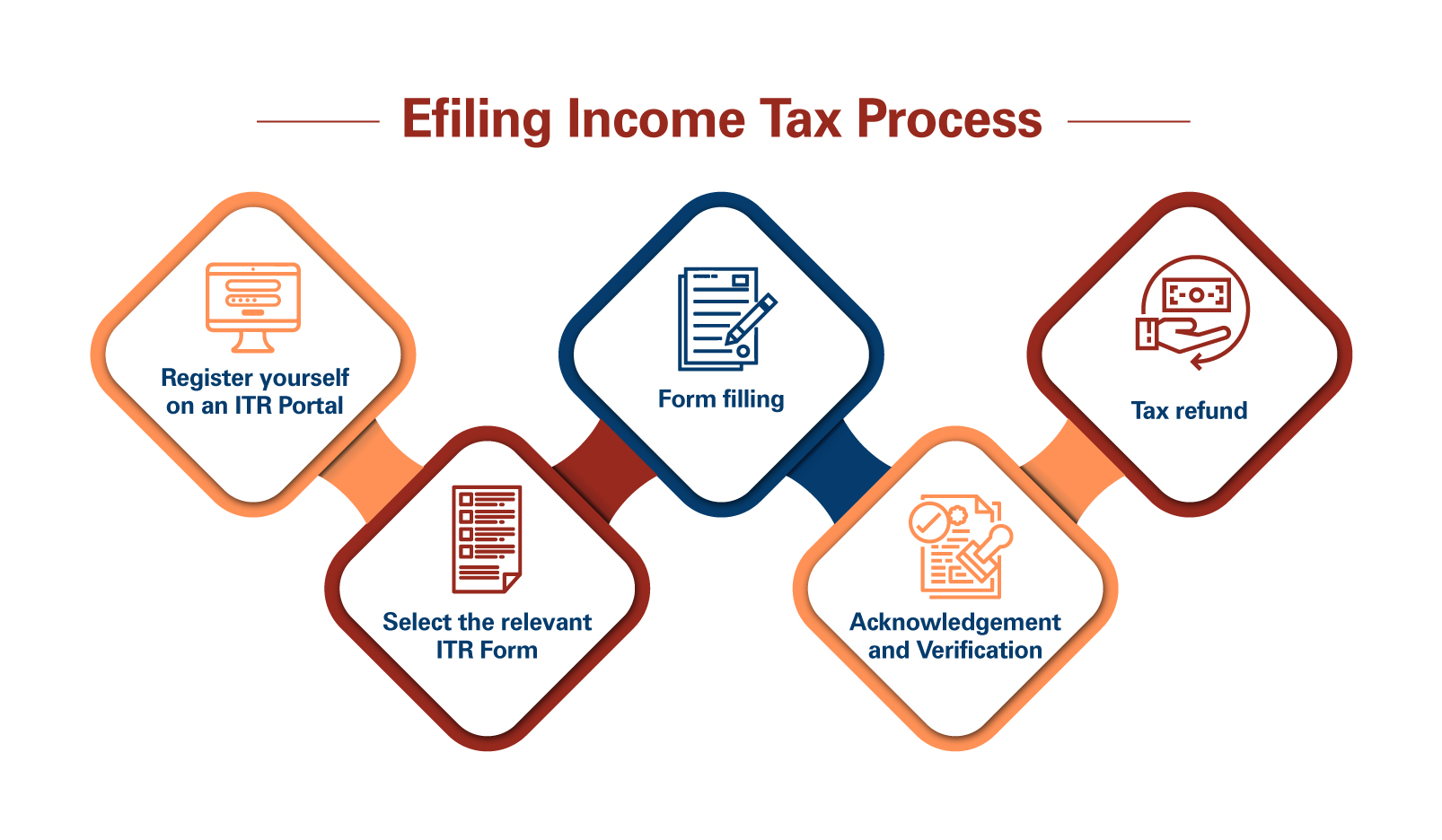

When Income Tax filing is mandatory?

Income Tax filing The requirement to file an ITR depends on various factors, including the individual’s income level, residential status, and specific conditions outlined in the Income Tax Act, 1961. 1.Income Threshold: Individuals with a total income exceeding the prescribed threshold are generally require to file an ITR. The income threshold varies based on… Read More »