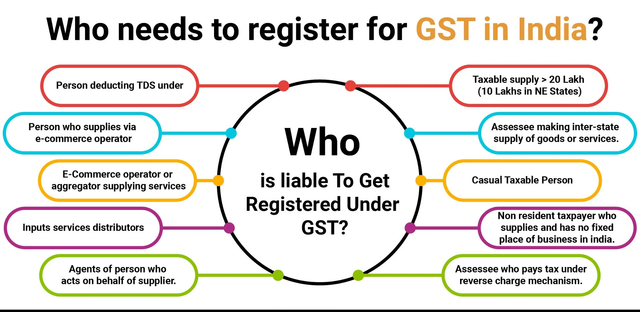

When GST registration is compulsory?

GST Registration is Compulsory In India, GST (Goods and Services Tax) registration is compulsory under the following circumstances: 1. Threshold Limit: If your annual aggregate turnover of taxable supplies (goods or services) exceeds the prescribed threshold limit, Compulsory GST registration. The threshold limit varies based on the state in which your business operates. As… Read More »