What are the benefits of having a GST registration in India if your monthly turnover is less than INR one lakh?

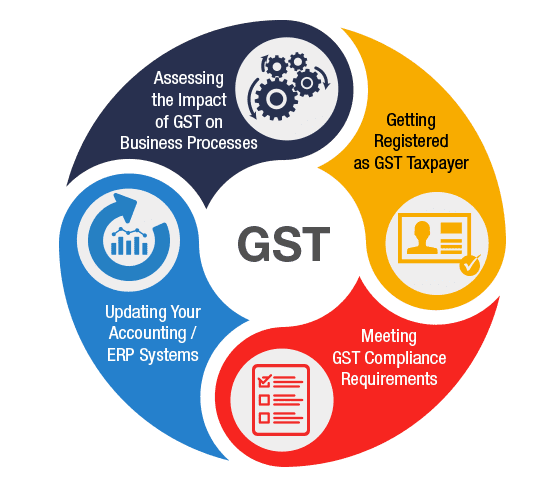

GST Registration in India for less than 1 lakh monthly turnover GST Registration in India for less than 1 lakh monthly turnover: In India, Goods and Services Tax (GST) registration is a significant step for businesses, even for those with a monthly turnover of less than INR one lakh. While many small businesses may… Read More »