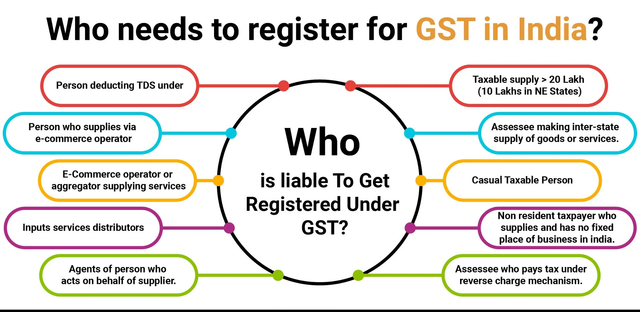

Q 9.16 Voluntary GST registration: When to take gst registration?

Voluntary GST registration Website Link: The following circumstances outline voluntary GST registration becomes a requirement. Threshold Limit: If your annual aggregate turnover of taxable supplies (goods or services) exceeds the specified threshold limit, you are required to take GST registration. The threshold limit varies based on the state in which your business operates. As of… Read More »