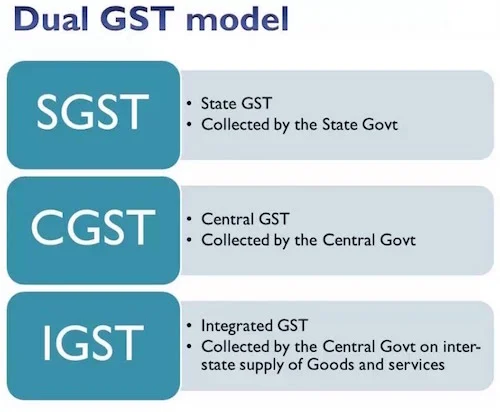

What is tax registration number in India?

Tax Registration Number To acquire the PAN (Permanent Account Number) using a GST (Goods and Services Tax) Tax Registration Number number in India, please adhere to the subsequent instructions: 1. Visit the official GST portal: Go to the Goods and Services Tax (GST) portal website of India at www.gst.gov.in. 2. Click on “Search Taxpayer”:… Read More »