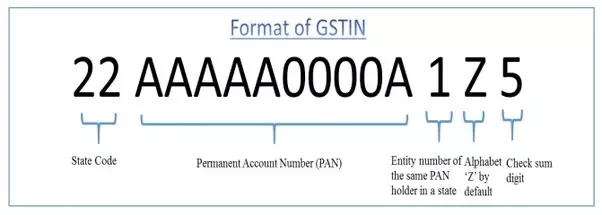

Where is pan number in gst number?

Finding PAN in GSTIN Finding PAN in GSTIN, The PAN (Permanent Account Number) is not directly embedded within the GST (Goods and Services Tax) number. However, the PAN number is used as a basis for generating the GSTIN (GST Identification Number). In the GSTIN, the PAN number is included as part of the structure. For… Read More »