TAN vs GST?

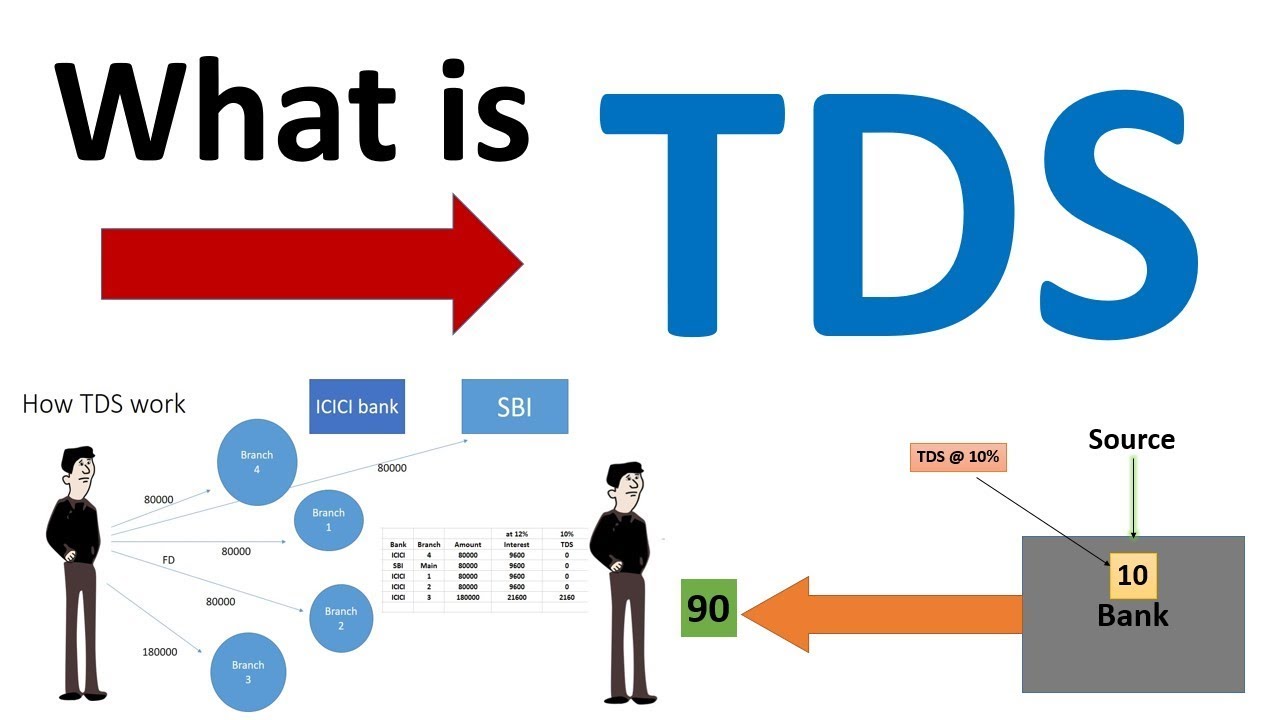

TAN vs GST Here are some key differences between TAN vs GST: Purpose: TAN: TAN is a unique 10-digit alphanumeric identifier issued to entities responsible for deducting or collecting tax at source (TDS). It uses for TDS-related purposes, such as deducting tax from payments made to employees, contractors, or other parties, and remitting it to… Read More »