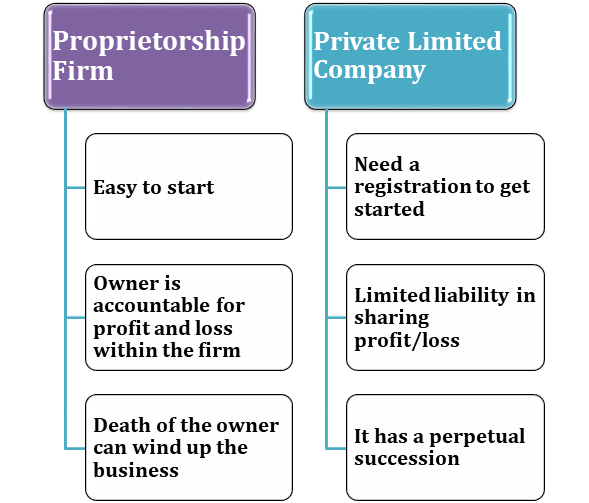

What is an Limited Liability Partnership?

An Limited Liability Partnership An LLP is a legal business structure that combines the features of a partnership and a corporation. It provides limited liability protection to its partners while allowing them to actively participate in the management of the business. An LLP is a separate legal entity, distinct from its partners, and it offers… Read More »