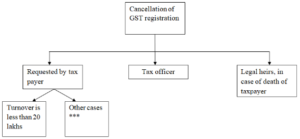

GST registration cancellation process

GST registration cancellation process, In India, the cancellation of GST (Goods and Services Tax) registration can occur in specific situations as outlined below:

Closure or Discontinuation of Business:

If a business ceases to exist, is closed, or is no longer liable to pay GST, the GST registration can be canceled. This may occur due to factors such as closure of the business.

Sale of the business, merger, amalgamation, or dissolution of the business entity.

Threshold Limit:

If a registered person’s annual aggregate turnover falls below the prescribed threshold limit, they can apply for cancellation of GST registration. The threshold limit for cancellation is Rs. 20 lakhs (Rs. 10 lakhs for Special Category States) for most businesses.

Except for specific categories like restaurants, catering services, and others where the threshold is Rs. 40 lakhs.

Transfer of Business:

In cases where a registered person transfers their business or changes the legal structure of the business, they can apply for cancellation of the existing GST registration and obtain a fresh registration in the name of the transferee or new entity.

Non-Compliance:

If a registered person fails to comply with the provisions of the GST law, such as not filing GST returns for a specified period or not paying tax dues for a certain period, the tax authorities may initiate cancellation proceedings.

Voluntary Cancellation:

A registered person can also voluntarily apply for cancellation of their GST registration if they no longer wish to continue their business activities or if they no longer meet the criteria for GST registration.

It’s important to note that the process and requirements for canceling GST registration may vary. GST registration cancellation process, one needs to submit an application through the GST portal.

Or seek assistance from a qualified tax professional who can guide them through the process.

To visit: https://services.gst.gov.in