![]()

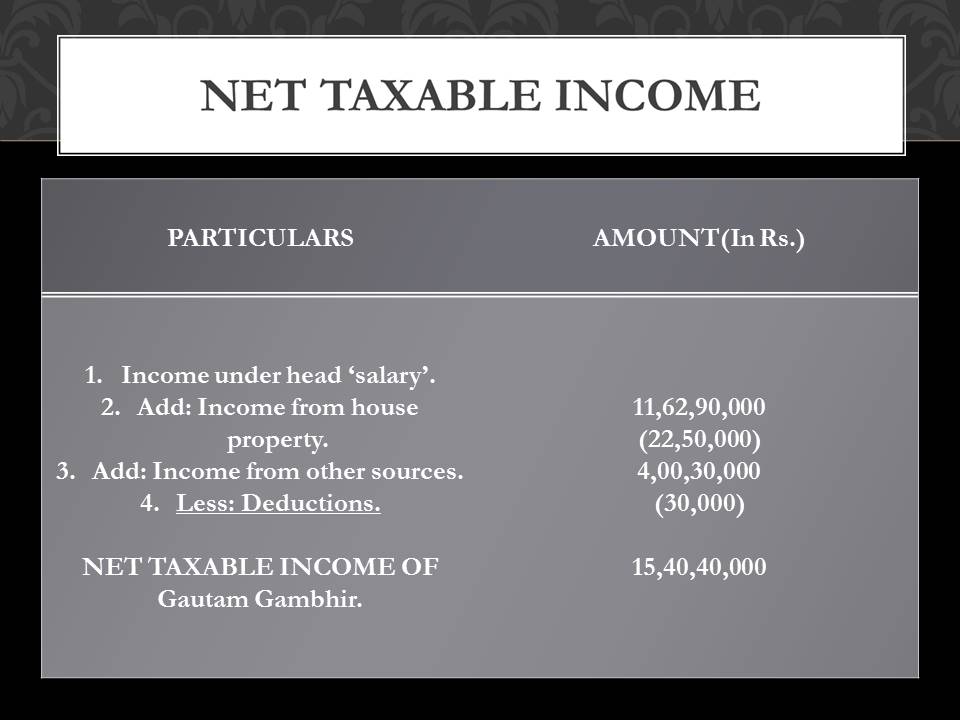

Net taxable income

Net Taxable income represents the portion of income that is liable to taxation after considering all eligible deductions and exemptions. It is the income remaining after deducting allowable expenses like contributions to provident fund, investments in specified tax-saving schemes, medical expenses, and more from the gross income.

To visit https://www.gst.gov.in/

To calculate this, these deductions are subtracted from the gross incomes. The resulting amount is then subjected to income tax based on the relevant tax rates. In India, income tax is imposed using progressive tax slabs, where higher rates are applied to higher income brackets.

For further details access our website https://vibrantfinserv.com