Introduction

In the modern business landscape, administrative and financial tasks play a crucial role in ensuring smooth operations. Two key roles that often get confused are data entry and bookkeeping. While both roles involve handling data and working with financial information, they differ significantly in terms of job responsibilities, skill requirements, and overall purpose. Understanding these differences is essential for businesses to assign the right tasks to the right professionals and for job seekers to align their career goals with the correct role.

This article explores the fundamental differences between data entry and bookkeeping, including their definitions, job descriptions, benefits, limitations, and applications. A comparative table will help clarify the distinctions between these two roles, and the article will conclude with answers to frequently asked questions (FAQs) to provide deeper insights.

Definition

What is Data Entry?

Data Entry refers to the process of inputting, updating, and maintaining data in computer systems or databases. The primary task of a data entry professional is to ensure that information is accurately recorded and stored for easy access and analysis.

A data entry clerk or data entry operator is responsible for:

- Entering numerical and text data into databases

- Verifying the accuracy of data entries

- Updating existing records

- Organizing and maintaining digital and physical files

- Generating reports based on data input

What is Bookkeeping?

Bookkeeping involves the recording, organizing, and maintaining of a company’s financial transactions. Bookkeepers are responsible for ensuring that financial records are accurate and up to date, which helps businesses track their financial performance and meet legal requirements.

A bookkeeper is responsible for:

- Recording daily financial transactions (e.g., sales, purchases, payments)

- Maintaining general ledgers

- Reconciling bank statements

- Preparing financial reports

- Managing accounts payable and receivable

Importance of Understanding the Difference

Understanding the difference between data entry and bookkeeping is important for several reasons:

Efficient Workforce Allocation – Assigning the right person to the right job improves productivity and efficiency.

Cost Management – Hiring a bookkeeper for data entry tasks (or vice versa) can lead to unnecessary costs.

Strategic Planning – Bookkeeping data influences business strategy, while data entry ensures operational accuracy.

Career Clarity – Professionals can pursue the correct training and career path based on a clear understanding of each role.

Benefits of Data Entry and Bookkeeping

✅ Benefits of Data Entry

- Improved Data Accuracy – Accurate data helps businesses make informed decisions.

- Operational Efficiency – Quick and efficient data handling improves overall business operations.

- Cost-Effective – Hiring data entry clerks is relatively affordable compared to specialized financial professionals.

- Flexibility – Data entry roles are often available as remote or part-time jobs, providing flexibility to employees.

✅ Benefits of Bookkeeping

- Financial Clarity – Helps businesses maintain accurate financial records.

- Compliance and Tax Reporting – Ensures the company meets legal and tax obligations.

- Strategic Decision-Making – Provides financial insights that support business growth.

- Cash Flow Management – Helps businesses track income and expenses effectively.

- Audit Preparation – Ensures the company’s financial records are ready for internal or external audits.

Usage of Data Entry and Bookkeeping

📌 Data Entry Usage

- Recording customer information in CRM systems

- Updating employee records in HR databases

- Entering product details into e-commerce platforms

- Organizing survey responses and feedback

- Processing shipping and order data

📌 Bookkeeping Usage

- Recording sales and purchase transactions

- Tracking accounts receivable and payable

- Preparing financial reports for management

- Reconciling bank and credit card statements

- Managing payroll processing

Limitations of Data Entry and Bookkeeping

❌ Limitations of Data Entry

- Limited Scope – Data entry focuses on recording information, not analyzing it.

- Repetitive Work – Data entry tasks can be monotonous, leading to reduced engagement.

- Human Error – Manual data entry is prone to mistakes, affecting data quality.

- Lack of Strategic Insight – Data entry does not provide financial or business insights.

❌ Limitations of Bookkeeping

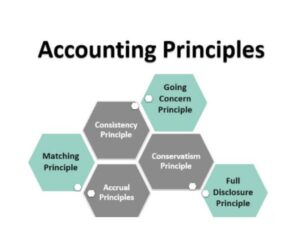

- Complexity – Bookkeeping requires knowledge of accounting principles and financial regulations.

- Cost – Professional bookkeepers are more expensive to hire than data entry clerks.

- Legal Responsibility – Inaccurate bookkeeping can lead to legal and tax issues.

- Software Dependency – Bookkeeping often requires specialized accounting software, increasing operational costs.

Application of Data Entry and Bookkeeping

✅ Application of Data Entry

- Healthcare – Recording patient data and medical history

- Retail – Managing product inventory and sales data

- Marketing – Handling customer feedback and survey data

- Logistics – Tracking shipment and delivery records

- Education – Updating student and course information

✅ Application of Bookkeeping

- Corporate – Preparing financial statements for stakeholders

- Small Businesses – Tracking income and expenses

- Nonprofits – Managing donor contributions and spending

- Government – Ensuring public funds are accounted for

- Hospitality – Tracking daily revenue and operational expenses

Comparative Table

The table below summarizes the key differences between data entry and bookkeeping:

| Aspect | Data Entry | Bookkeeping |

|---|---|---|

| Purpose | Recording and organizing data | Managing financial transactions and reports |

| Skills Required | Typing, accuracy, attention to detail | Accounting knowledge, financial analysis, software proficiency |

| Complexity | Low | High |

| Impact | Operational efficiency | Financial health and compliance |

| Software Used | MS Excel, Google Sheets, CRM systems | QuickBooks, Xero, SAP, FreshBooks |

| Educational Requirement | High school diploma or equivalent | Degree or certification in accounting or finance |

| Cost of Hiring | Low | High |

| Legal Impact | Minimal | High (related to tax and financial compliance) |

| Focus | Data accuracy and organization | Financial accuracy and reporting |

| Career Path | Administrative roles | Accounting and finance roles |

Conclusion

While data entry and bookkeeping may seem similar at first glance, they serve different purposes and require different skill sets. Data entry focuses on recording and organizing information, ensuring operational accuracy. In contrast, bookkeeping involves financial record-keeping, compliance, and strategic financial planning. Understanding these differences helps businesses allocate resources effectively and enables professionals to make informed career choices. By assigning the right tasks to data entry clerks and bookkeepers, companies can improve both operational efficiency and financial health.

Frequently Asked Questions (FAQs)

1. What is the primary difference between data entry and bookkeeping?

Data entry focuses on recording and organizing data, while bookkeeping involves managing financial transactions and preparing reports.

2. Can a data entry clerk handle bookkeeping tasks?

No, bookkeeping requires specialized financial knowledge and skills beyond basic data entry.

3. What qualifications are required for a data entry job?

A high school diploma and basic computer skills are typically sufficient.

4. Do bookkeepers need to know accounting?

Yes, bookkeepers require knowledge of accounting principles and financial regulations.

5. Is data entry a good entry-level job?

Yes, data entry is often a starting point for administrative careers.

6. Are bookkeepers responsible for filing taxes?

Bookkeepers prepare financial records but usually do not file taxes directly.

7. Can data entry errors affect business operations?

Yes, incorrect data entry can lead to poor business decisions and operational inefficiencies.

8. What software is commonly used for data entry?

MS Excel, Google Sheets, and CRM software are commonly used.

9. How often should financial records be updated?

Bookkeepers should update records regularly, ideally daily or weekly.

10. Is bookkeeping more stressful than data entry?

Yes, bookkeeping involves greater responsibility and legal implications, which can increase stress levels.

To Visit: https://www.incometax.gov.in

For further details access our website https://vibrantfinserv.com