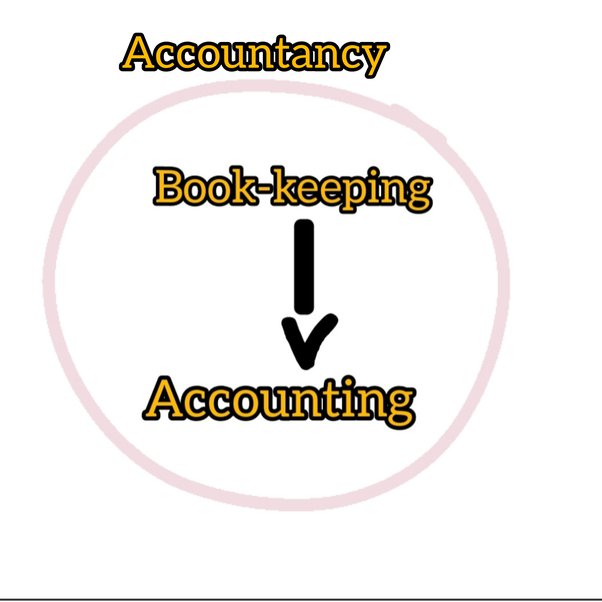

Book keeping and Accountancy difference

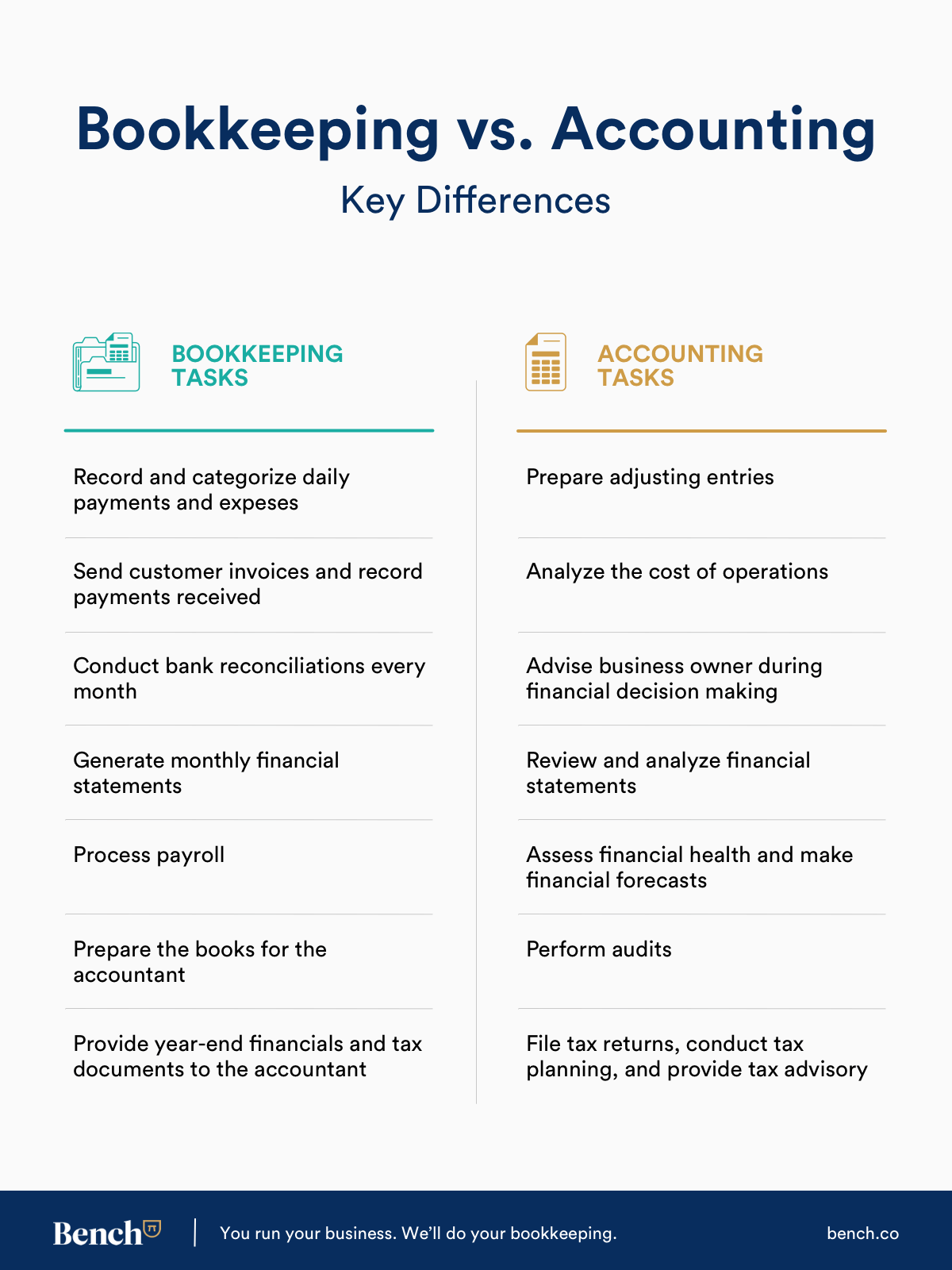

Bookkeeping v/s Accountancy Bookkeeping v/s Accountancy, Bookkeeping can be accomplished without relying on QuickBooks or any other accounting software, while still maintaining its distinctiveness: 1. Scope: Bookkeeping primarily focuses on recording and organizing financial transactions, such as recording sales, purchases, payments, and receipts. It involves maintaining accurate and detailed records of these transactions using journals, ledgers,… Read More »