How can ITR file?

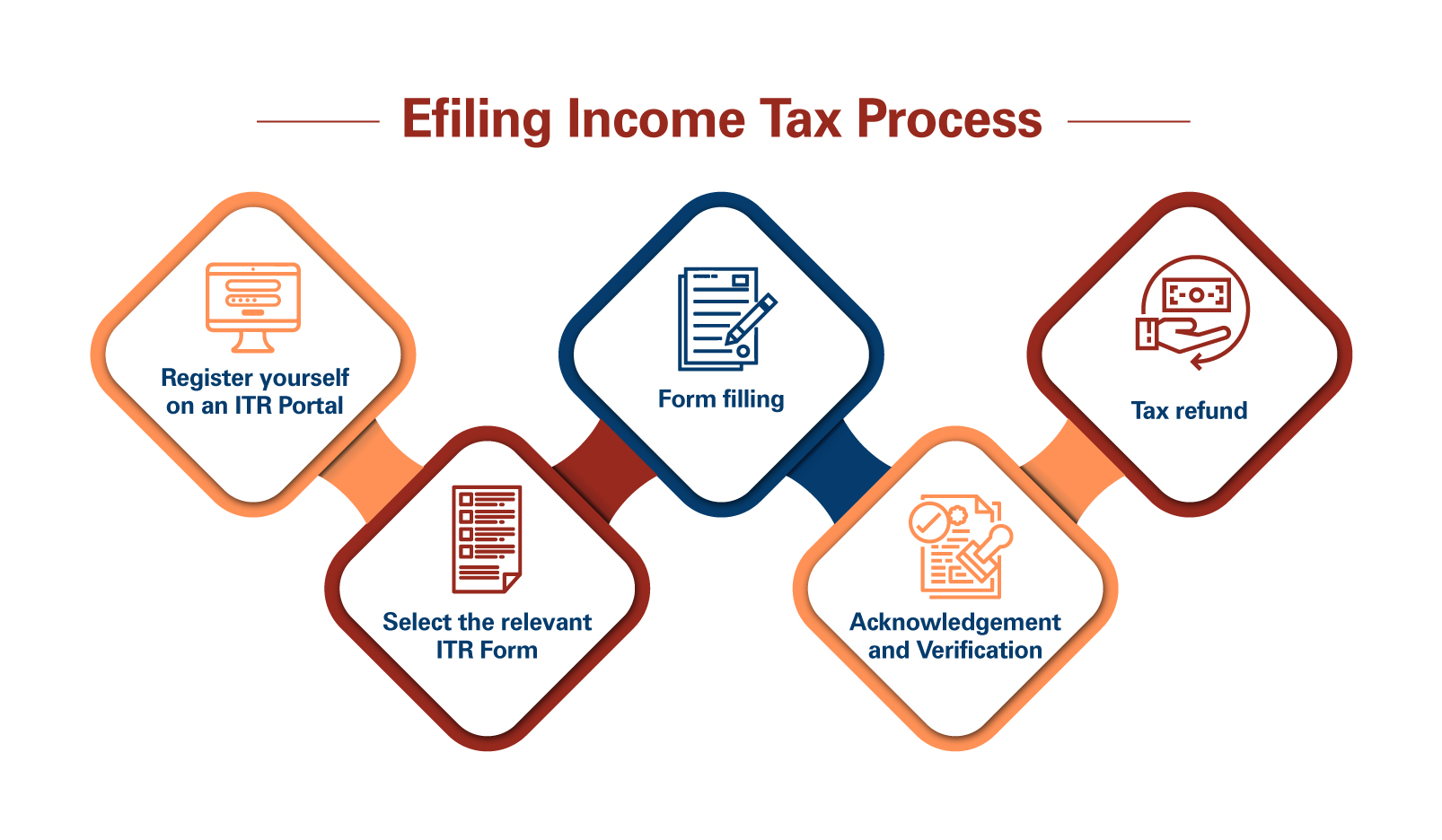

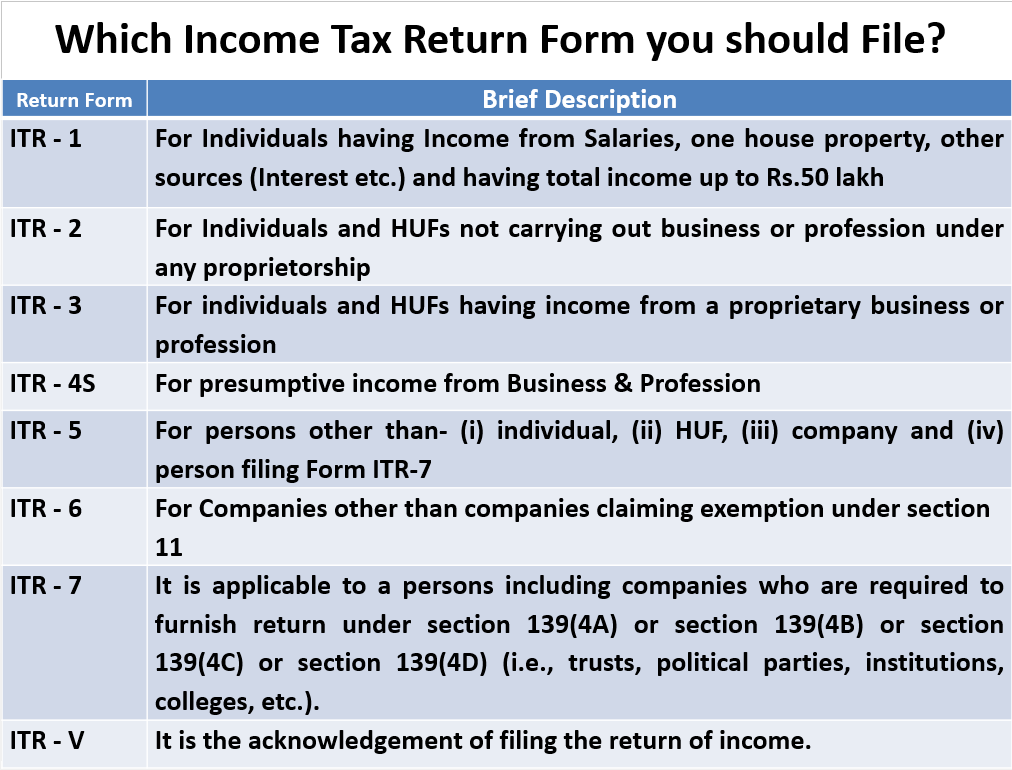

Income Tax Return To file an Income Tax Return (ITR), you can follow these steps: 1. Gather the Required Documents: Collect all the necessary documents, such as PAN card, Aadhaar card, bank statements, salary slips, Form 16 (if available), investment proofs, and other relevant financial documents. 2. Choose the Correct ITR Form: Select the… Read More »