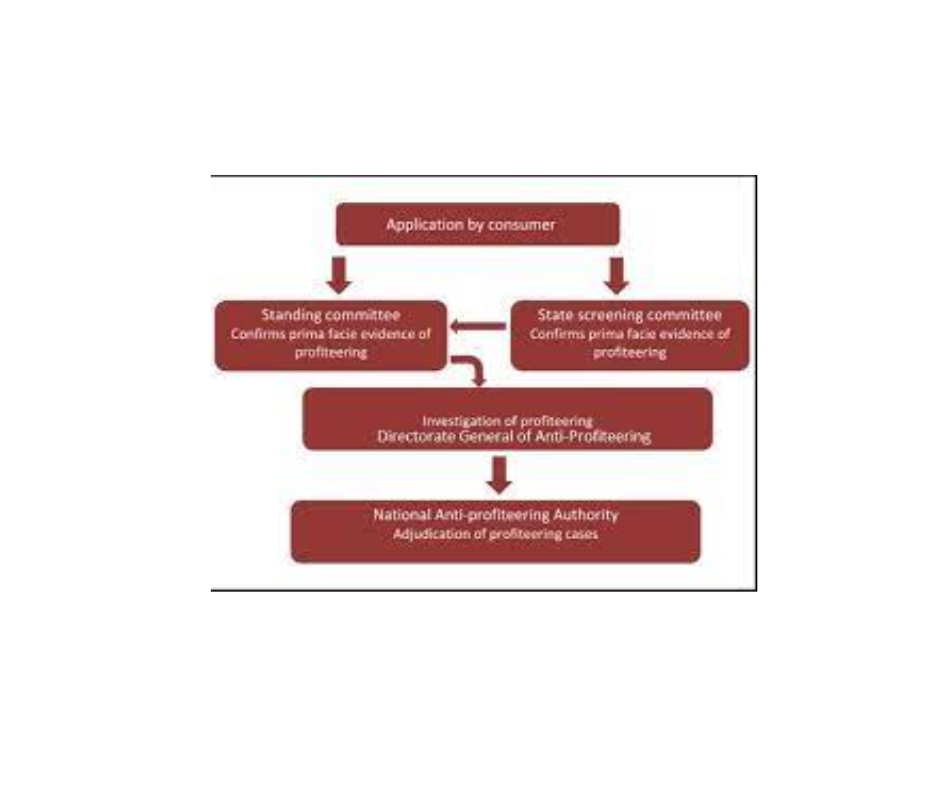

Which is the statutory authority under the GST law to check unfair profiteering activities?

Statutory authority Statutory authority under the GST law to check unfair profiteering activities is the National Anti-Profiteering Authority (NAA). The NAA is a quasi-judicial body that was set up under the GST Act to ensure that the benefits of GST rate reductions and input tax credit are passed on to the end consumers by the… Read More »