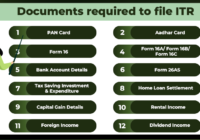

What documents are needed to file ITR as a fashion designer?

Documents Need to File ITR The Documents Need to File ITR as a fashion designer vary depending on the individual’s circumstances. There are some common documents for require filing ITR as follow: PAN card Aadhar card Bank account details Income from business or profession (Form 26AS) Income from salary (Form 16) Rent receipts (if… Read More »