30. Manpower Tax Solutions: What compliance measures should Manpower & Employment Agencies follow to avoid tax audit issues?

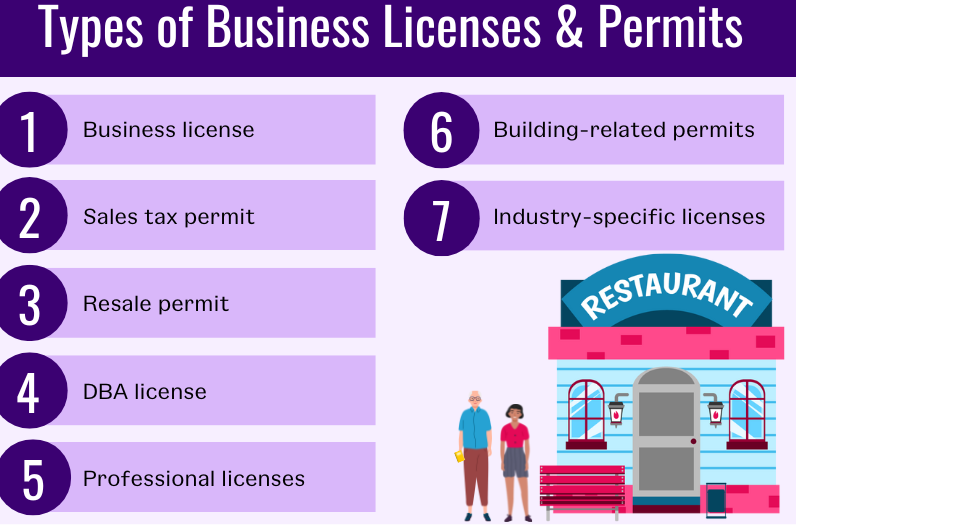

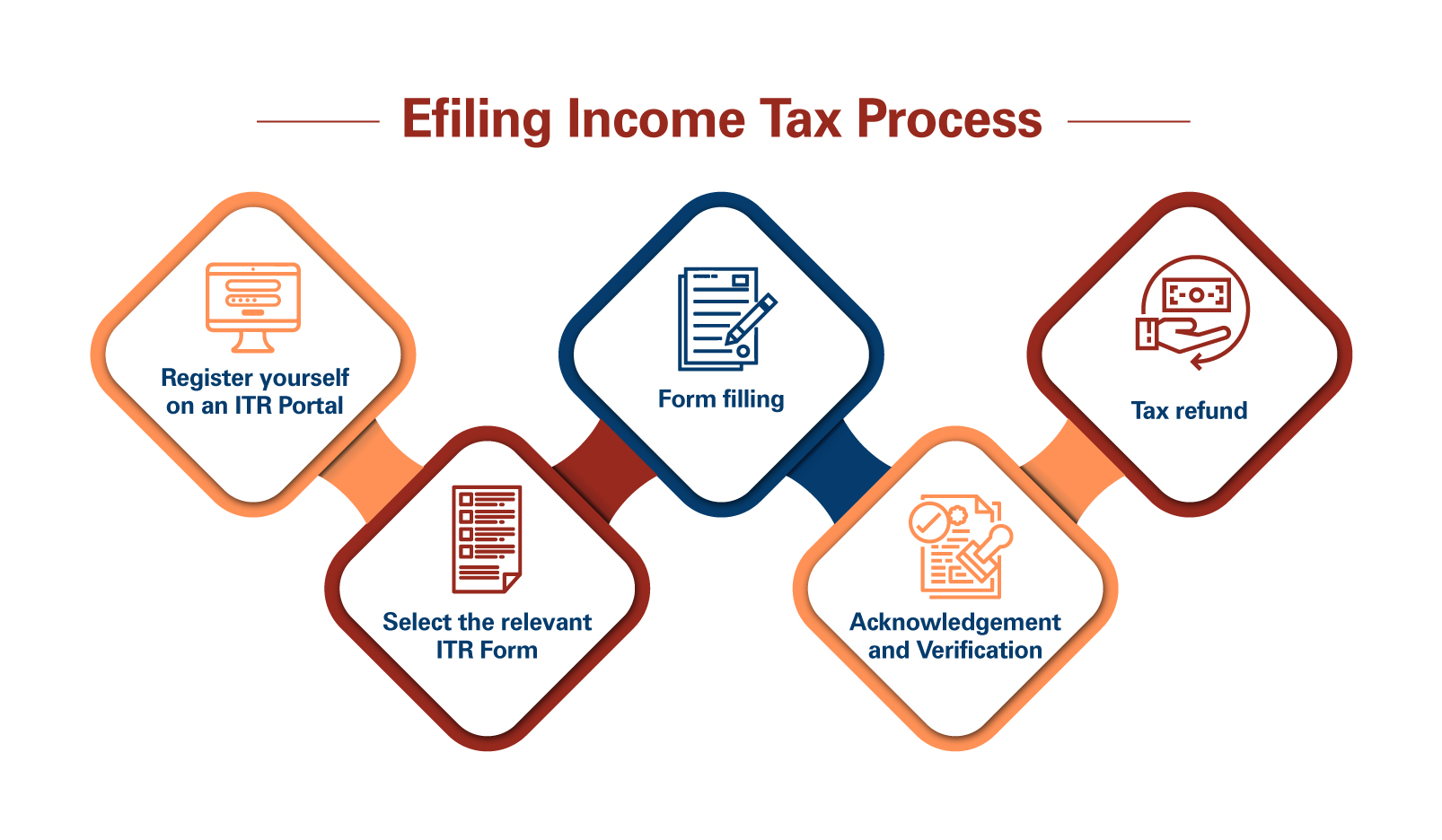

Manpower Tax Solutions Manpower Tax Solutions, here are some compliance measures that manpower and employment agencies should follow to avoid tax audit issues: 1. Register with the appropriate government agencies: Manpower and employment agencies are required to register with the appropriate government agencies, such as the Department of Labor and Employment (DOLE) and the Bureau… Read More »