Will GST be levied on a legal barter transaction done between 2 companies?

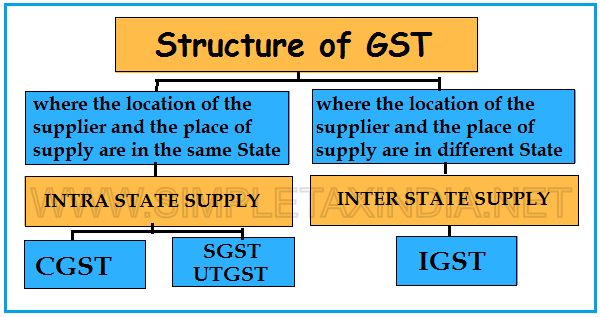

Legal barter transaction Legal barter transaction, Yes, GST (Goods and Services Tax) may be levy on a legal barter transactions done between two companies. According to the GST Act, any supply of goods or services made for a consideration in the course of business or commerce is taxable, including barter transactions. The value of… Read More »