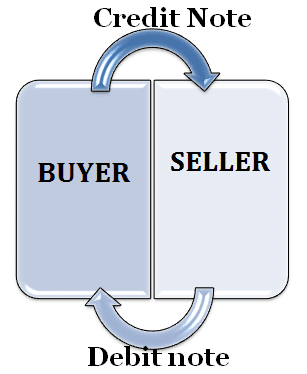

Can a supplier issue a credit note without GST charges?

Credit Note without GST Charges Credit note without GST charges, Yes, a supplier can issue a credits note without GST charge under certain circumstances. A credit note is typically issue to adjust or rectify an incorrect invoice or to provide a refund to the buyer. If the original invoice did not include Good and… Read More »