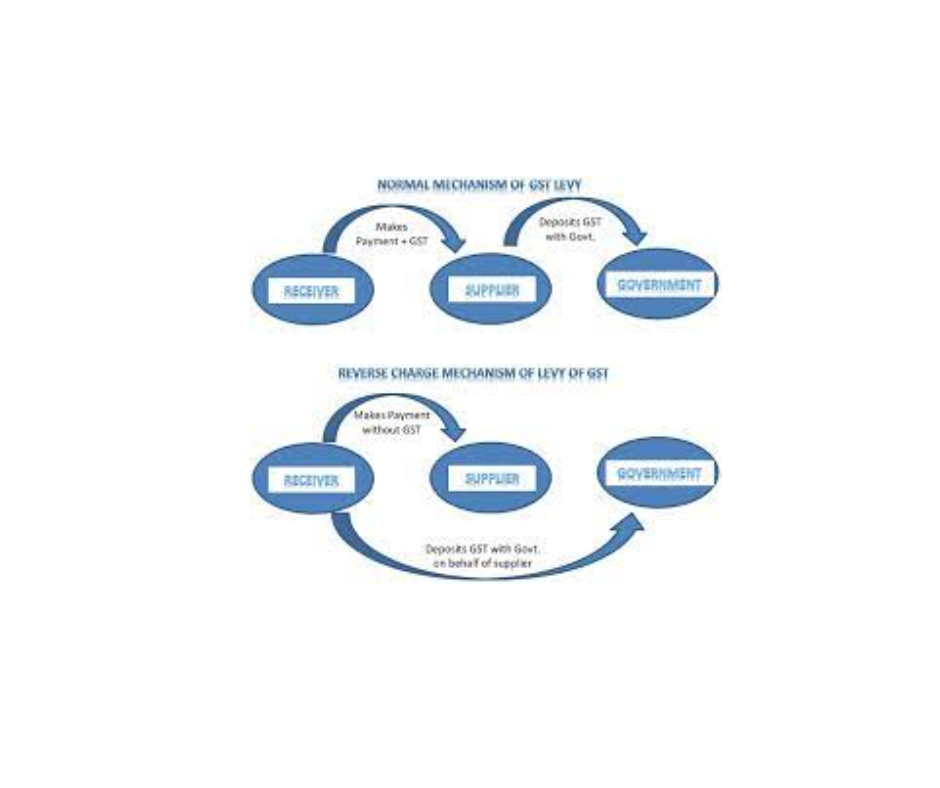

RCM in GST: What is the full form of RCM in GST?

RCM in GST The RCM stands for Reverse Charge Mechanism in GST. The Reverse Charge Mechanism is a concept under GST wherein the recipient of goods or services is liable to pay the GST instead of the supplier. To put it differently, the Reverse Charge Mechanism necessitates that the individual receiving goods or services obliged… Read More »