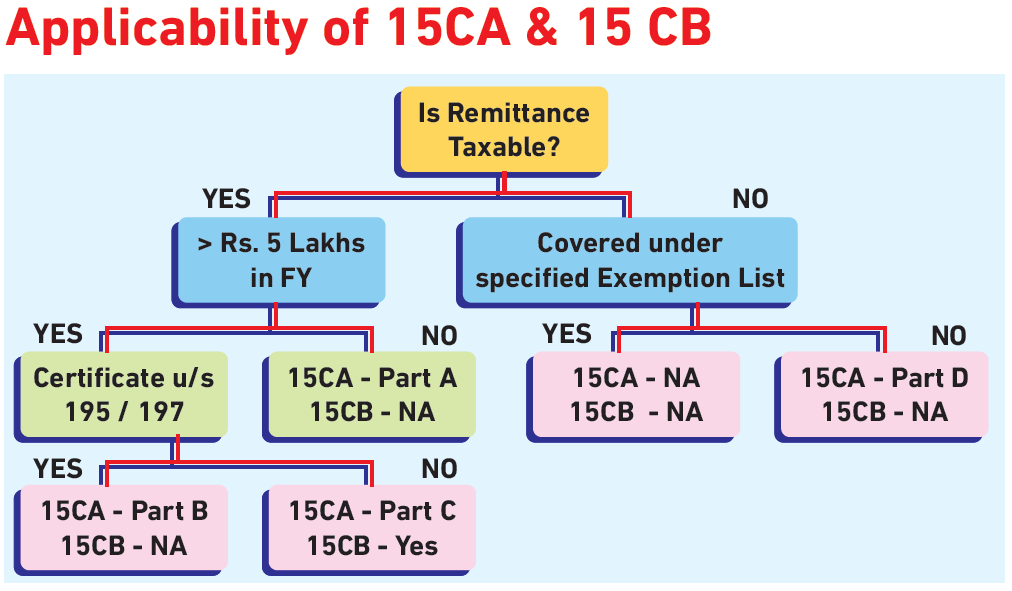

Differences between 15CA and 15CB?

User Intent Users searching for differences between Form 15CA and 15CB are likely individuals or businesses dealing with international transactions, remittances, or tax compliance in India. They want clarity on when to use each form, their applications, benefits, and limitations. Introduction When making payments to a non-resident outside India, compliance with income tax regulations… Read More »