What does it mean when we say GST is a destination based tax?

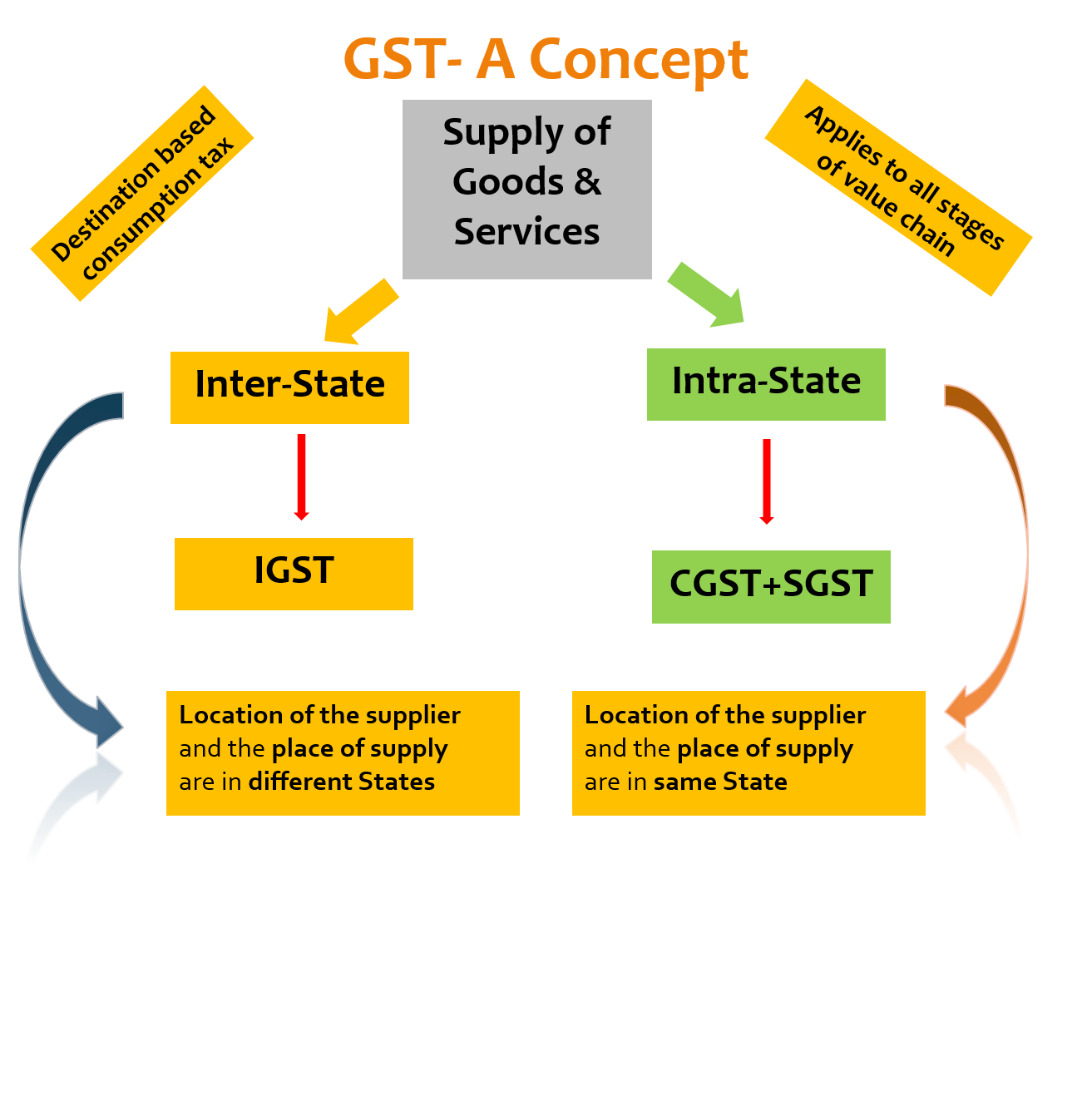

Introduction What does it mean when we say GST is a destination based tax? Goods and Services Tax (GST) is a revolutionary tax reform that has streamlined indirect taxation in many countries, including India. One of its key features is that it is a “destination-based tax. ” This means that the government levies tax at… Read More »