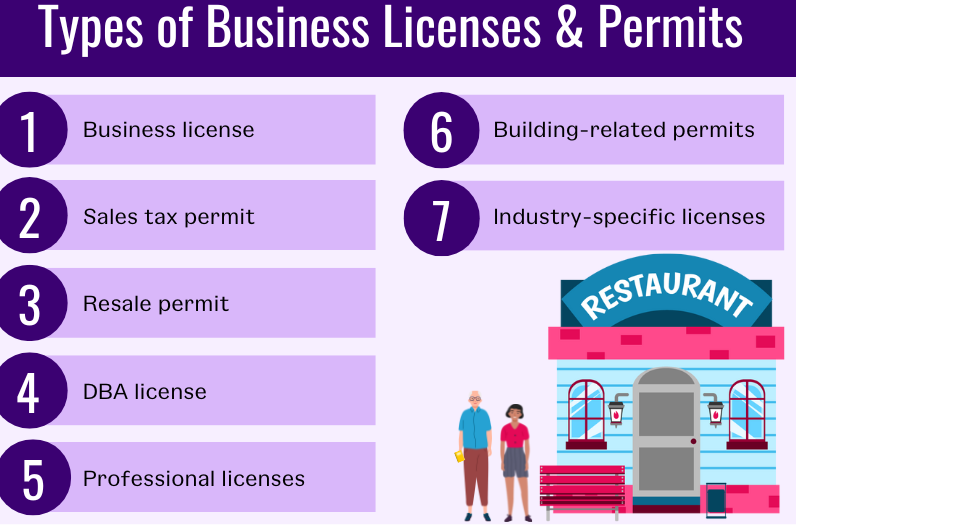

Are business licenses required in taxes?

Business Licenses for Taxes Business Licenses for Taxes Yes, business licenses generally required in Texas for many types of businesses. However, the specific licenses and permits needed can vary depending on the nature of the business and the location where it operates. Some common examples of licenses and permits required in Texas include: 1.… Read More »