What is difference between tan and gst?

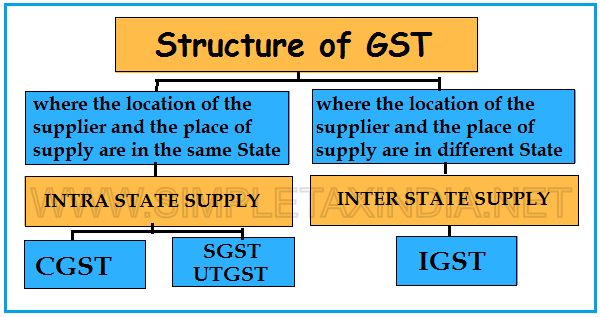

Tan vs. GST TAN (Tax Deduction and Collection Account Number) vs and GST (Goods and Services Tax) are two different tax-related identification numbers used in India. Here are the key differences between Tan vs. GST: Purpose: TAN: TAN is a unique identification number assigned to entities responsible for deducting or collecting tax at… Read More »