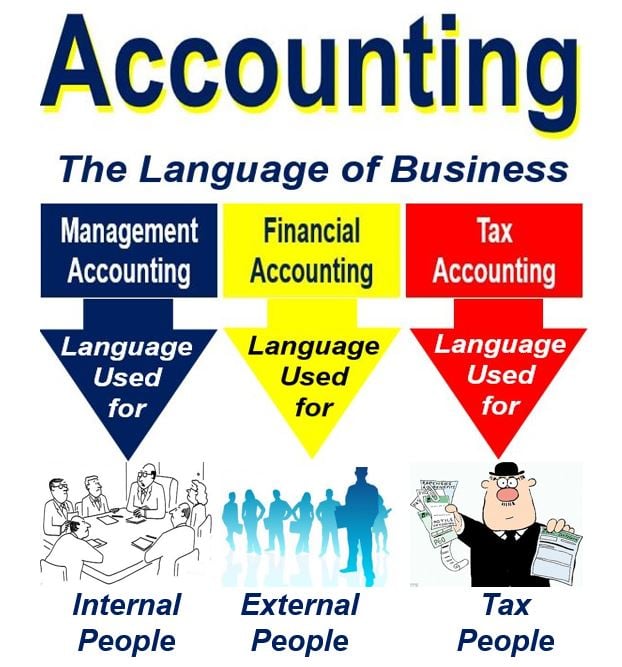

What is the meaning of accountancy?

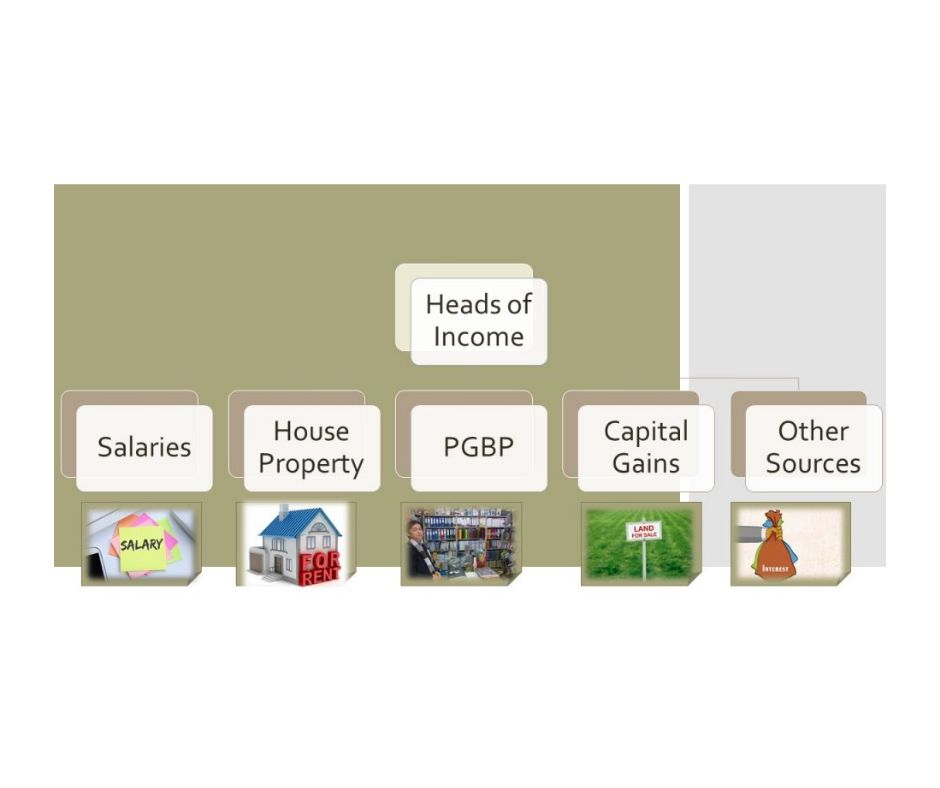

Meaning of accountancy Accountancy is a field of study and practice that deals with the measurement, processing, analysis, and communication of financial information about a business or organization. It involves the recording, classifying, summarizing, and interpreting of financial transactions to provide useful information for decision-making.The meaning of accountancy is very clear. To visit: https://www.incometax.gov.in Accountancy… Read More »