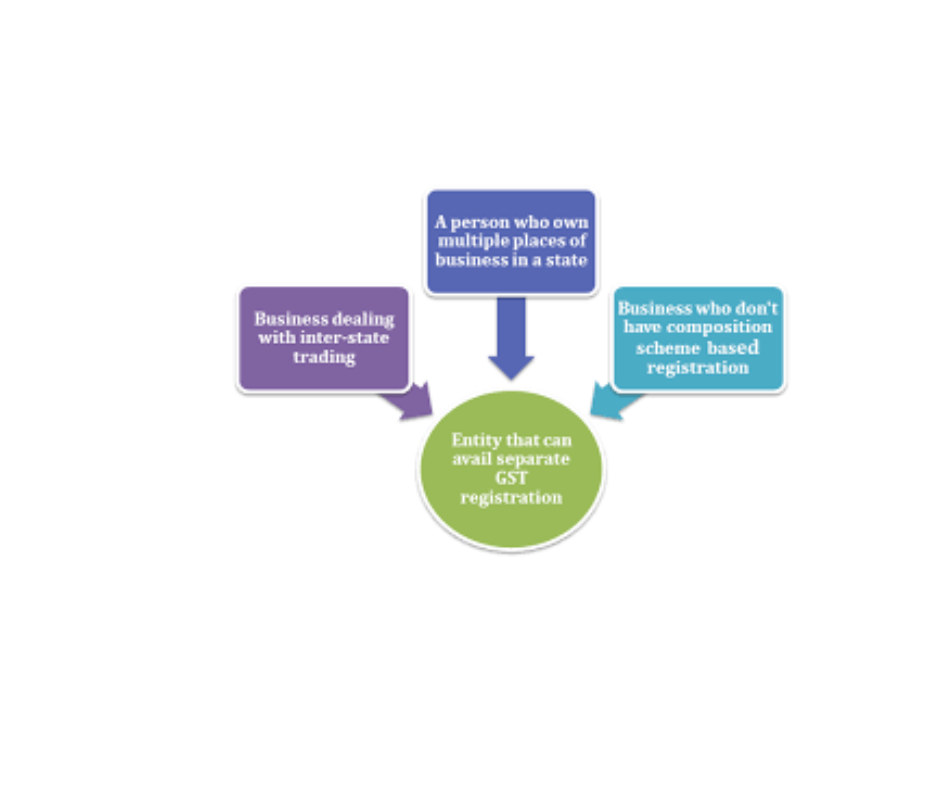

Can an individual person get registered under GST in India to sell online?

GSTRegistration for individuals GSTRegistration for individuals Yes, an individual person can get registered under GST in India to sell online. Businesses with an annual turnover exceeding Rs. 40 lakhs (or Rs. 20 lakhs in special category states) are required to mandatorily register for GST. In certain instances, individuals whose annual turnover falls below the prescribed… Read More »