What are the supporting documents of a trade name for the GST registration of a proprietorship?

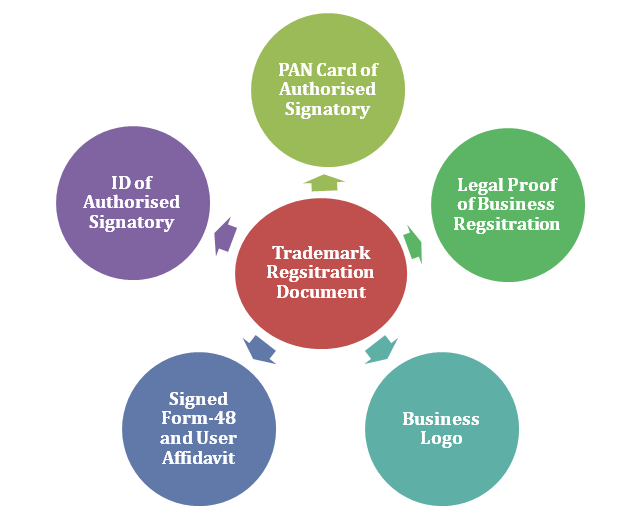

Supporting documents Supporting Documents, To register a trade name for GST (Goods and Services Tax) registration of a proprietorship in India, the following documents are generally required 1.PAN (Permanent Account Number) card of the proprietor: PAN card is a mandatory requirement for GST registration. It serves as an identity proof for the proprietor. 2.… Read More »