What is 15CB?

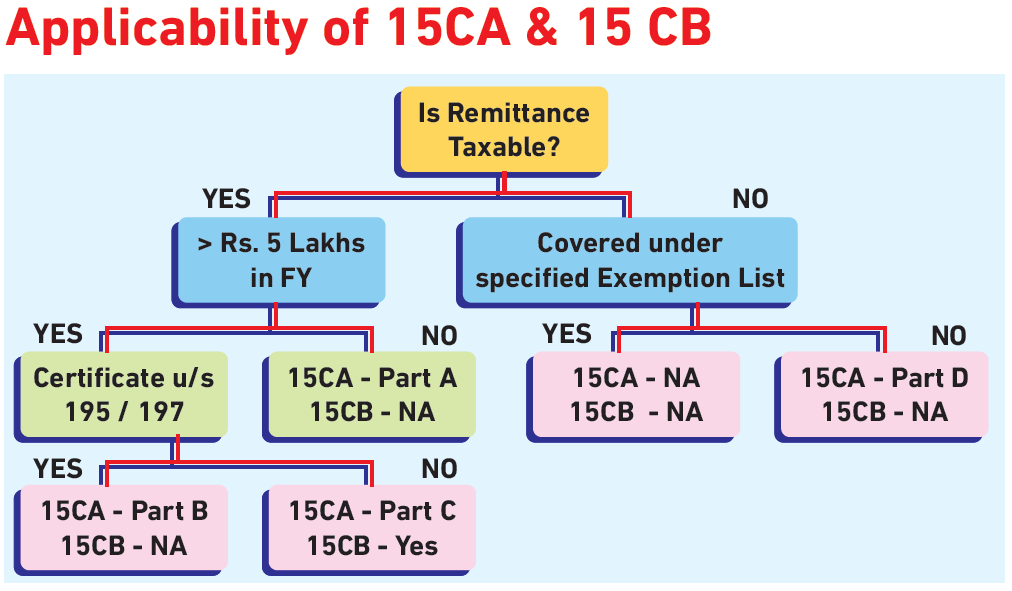

Form 15CB Form 15CB is a certificate issued by a Chartered Accountant (CA) in India. It is require for certain international transactions involving the transfer of money to non-resident individuals or entities. Here’s an explanation of Form 15CB meaning: 1.Purpose: It is use to certify that the remittance being made to a non-resident or… Read More »