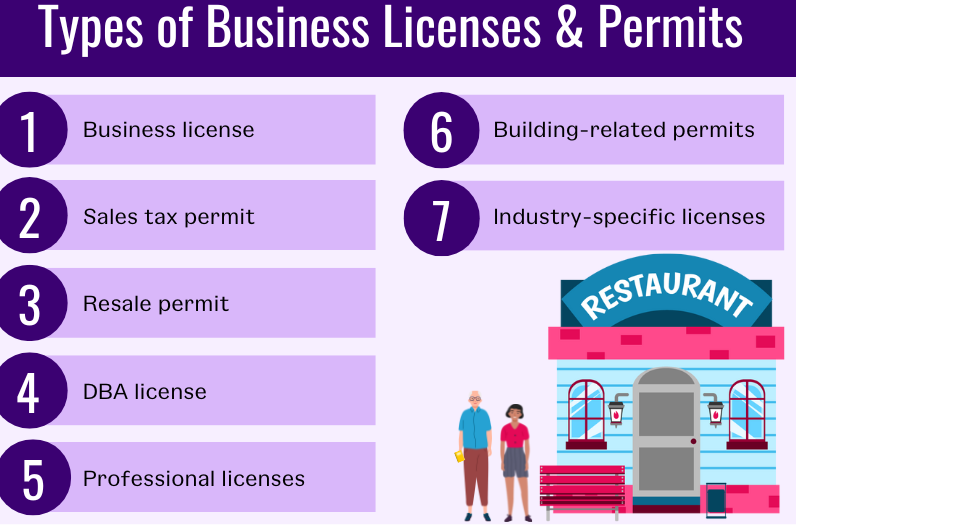

Is fssai license mandatory for small business?

FSSAI License Mandatory for Small Business FSSAI License Mandatory for Small Business, Yes, obtaining an FSSAI (Food Safety and Standards Authority of India) license is mandatory for small businesses that are involve in food-related activities. The FSSAI is the governing body responsible for regulating and supervising the food safety and hygiene standards in India.… Read More »