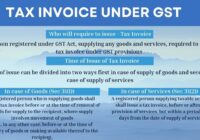

If we make cash sales, should we issue a tax invoice for GST?

User Intent When businesses make cash sales, they often wonder whether they need to issue a tax invoice for Goods and Services Tax (GST). This article clarifies the GST invoicing requirements for cash transactions, explaining when and how a tax invoice should be issued. Introduction GST regulations can be confusing, especially when dealing with cash… Read More »