GST for Construction Work

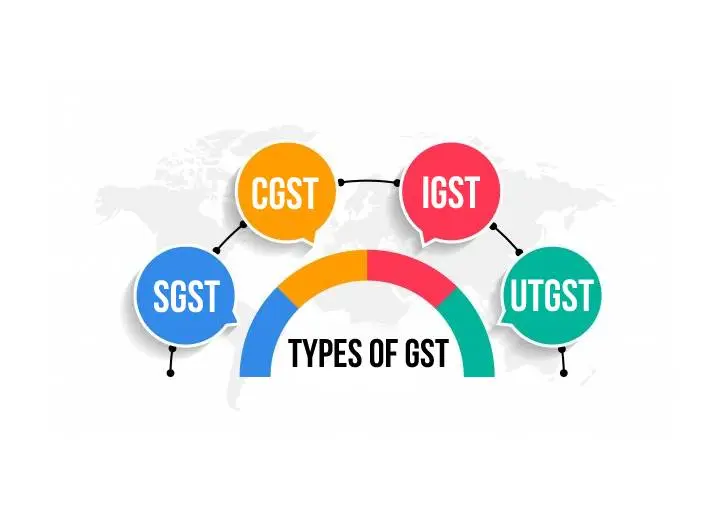

The construction industry is one of the largest sectors in India, contributing significantly to the country’s GDP. With the introduction of the Goods and Services Tax (GST) on July 1, 2017, the taxation structure for construction work underwent a major transformation. Earlier, the industry was subject to multiple taxes like Value Added Tax (VAT), Service… Read More »