Is mandatory DSC for proprietor ship in GST?

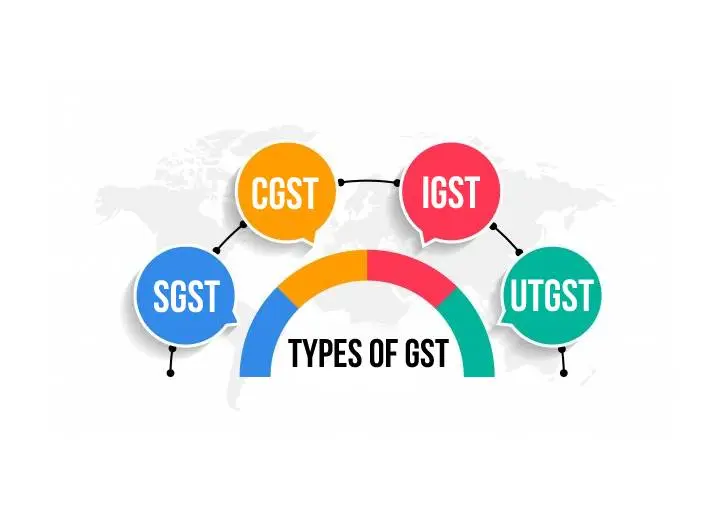

Introduction The Goods and Services Tax (GST) in India is a comprehensive tax system that affects businesses of all sizes, including proprietorships. To ease the process of GST registration, the government introduced the concept of Digital Signature Certificates (DSC). A question that often arises is whether a DSC is mandatory for proprietorships under the GST… Read More »