GST compliance list?

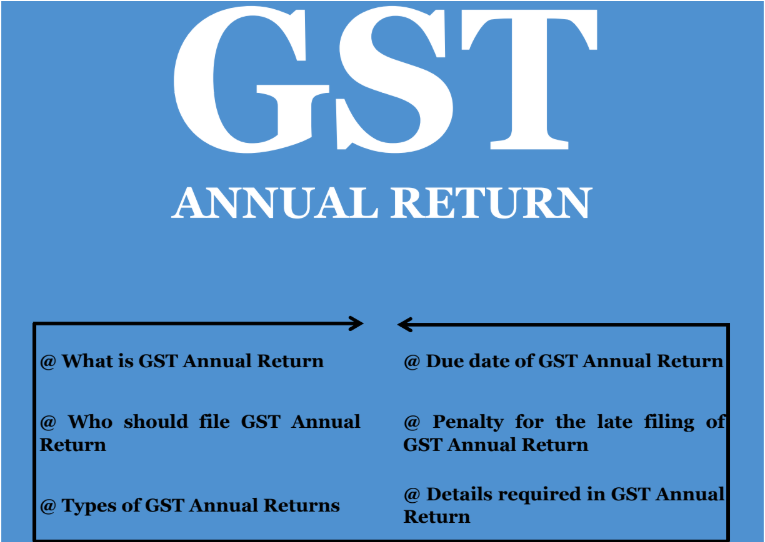

GST Compliance Checklist GST compliance checklist, Maintaining compliance with the Goods and Services Tax (GST) regulations is crucial for businesses. While the specific requirements may vary depending on the country. Here is a general GST compliance checklist GST Registration: Ensure that your business is registered for GST as per the prescribed threshold limits and… Read More »