Gst filing compliance?

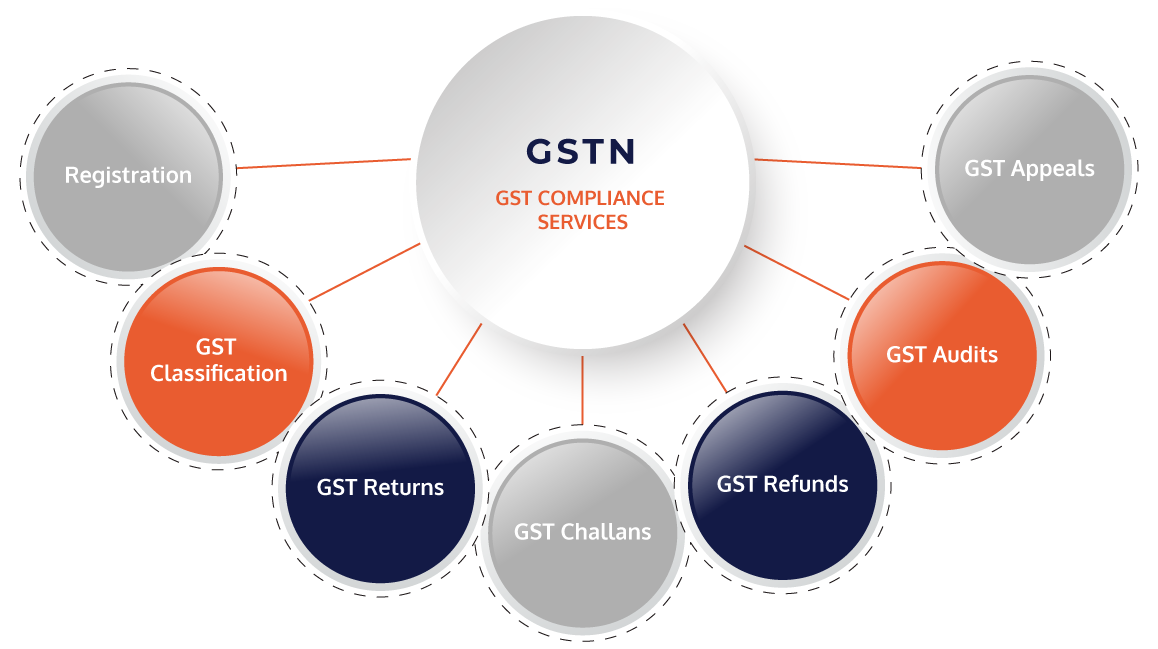

GST Filing Compliance GST filing compliance refers to the adherence to the regulations and requirements set forth by the tax authorities for filing Goods and Services Tax (GST) returns. Here are the key aspects of GST filing compliance: Timely Filing: Businesses must file their GST returns within the prescribed due dates. The frequency of filing… Read More »