Can one HSN code have multiple GST rates?

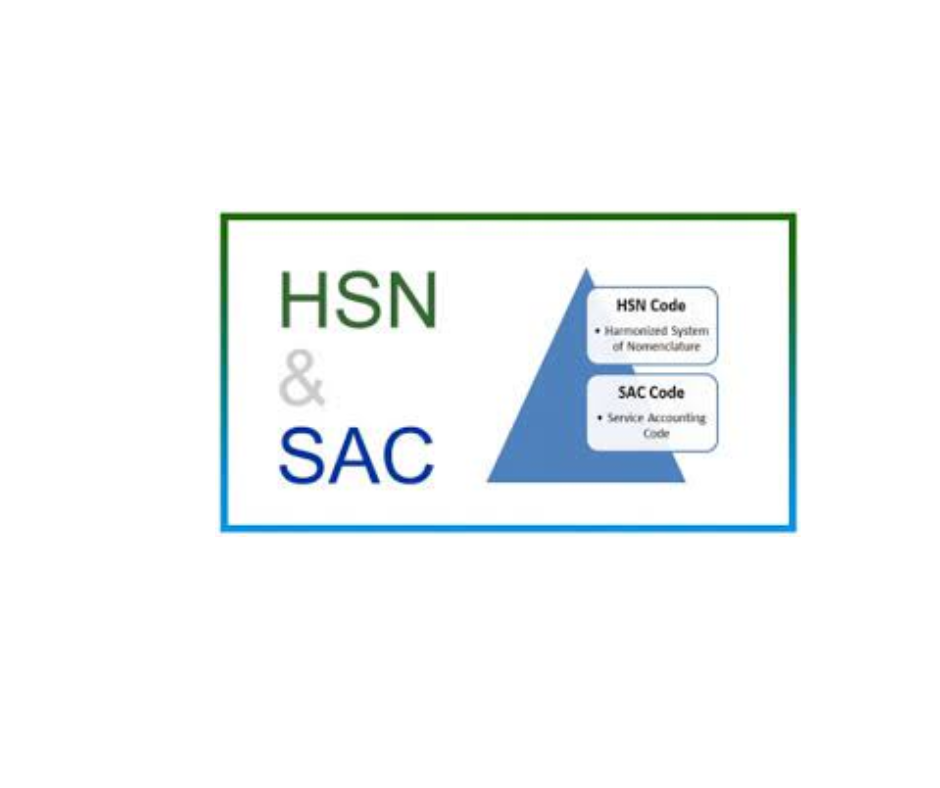

Can one HSN code have multiple GST rates The Harmonized System of Nomenclature (HSN) code is a globally recognized system of classifying goods, primarily for the purpose of taxation. Introduce by the World Customs Organization (WCO) in 1988, the HSN system is use by over 200 countries, including India, to classify goods in a standardize… Read More »