Can restaurants and hotels claim input tax credit (ITC) under the GST regime for ITR filing?

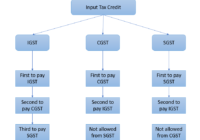

Input Tax Credit (ITC) The answer is not always. Restaurants and hotels can claim input tax credit (ITC) under the GST regime for ITR filing if they registered under GST and charge 18% GST on their food and beverage services. However, restaurants and hotels that charge 5% GST on their food and beverage services cannot… Read More »