What is the difference between interstate GST and intrastate GST?

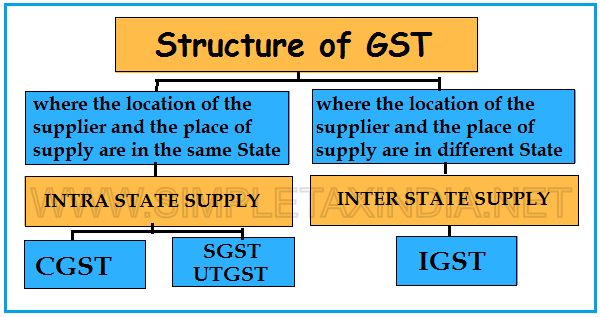

Interstate GST and Intrastate GST GST is applicable to both interstate GST and intrastate GST transactions, each with its own set of tax rates and regulations. GST, which stands for Goods and Services Tax, is a comprehensive indirect tax introduce in India on July 1, 2017. It replaced multiple indirect taxes levied by the… Read More »