Tag Archives: #FiscalResponsibility

Tax planning vs tax preparation?

Tax Planning: Tax planning involves proactive strategies and actions taken throughout the year to minimize tax liability and optimize financial outcomes. It focuses on analyzing the taxpayer’s financial situation, exploring tax-saving opportunities, and implementing strategies to legally reduce taxes. Tax planning aims to strategically manage financial affairs, take advantage of applicable tax laws and provisions,… Read More »

Tax planning vs tax compliance?

Tax planning vs tax compliance Tax planning vs tax compliance, Here’s a comparison between tax planning and tax compliance: Taxation Planning: Tax planning involves strategic decision-making and the implementation… Read More »

What is the requirements of GST Compliance?

GST Compliance Requirements What are the Requirements of GST Compliance? Introduction The Goods and Services Tax (GST) is an indirect tax levied on the supply of goods and services in many countries, including India. It was introduced to create a unified tax system, eliminating multiple indirect taxes. However, businesses must adhere to various GST… Read More »

Gst filing compliance?

GST Filing Compliance GST filing compliance refers to the adherence to the regulations and requirements set forth by the tax authorities for filing Goods and Services Tax (GST) returns. Here are the key aspects of GST filing compliance: Timely Filing: Businesses must file their GST returns within the prescribed due dates. The frequency of filing… Read More »

What measure reflects the difference between current assets and current liabilities?

Difference between current assets and current liabilities The measure that reflects the difference between current assets and current liabilities is called working capital. Working capital is calculated by subtracting the total current liability of a company from its total current asset. It is an important metric for businesses to monitor, as it indicates their ability… Read More »

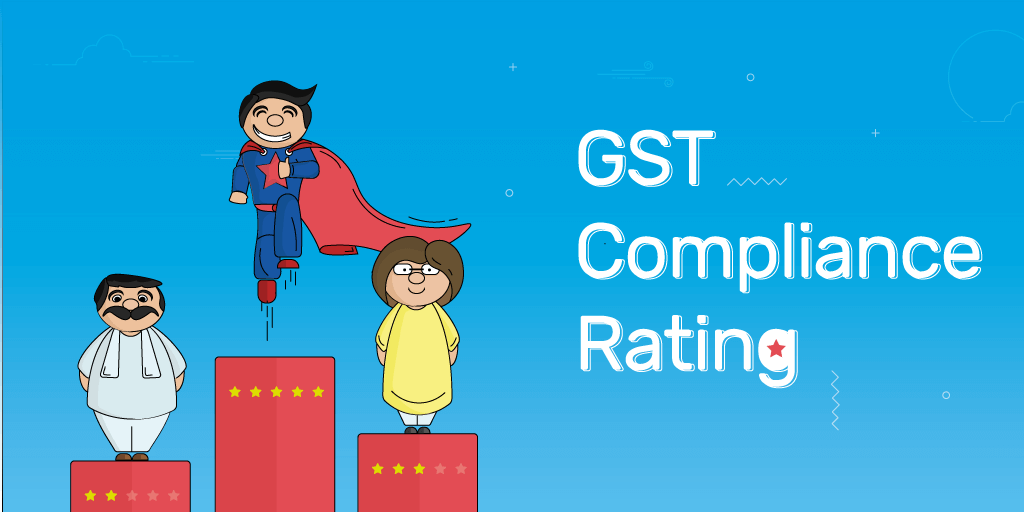

How to know gst compliance rating?

About GST compliance Rating GST compliance rating, In many countries where the GST (Goods and Services Tax) is implemented, tax authorities generally do not assign a specific “GST compliance rating” to businesses. However, businesses can assess their GST compliance by considering the following factors: 1.Timely GST Registration: Ensure that your business is register… Read More »

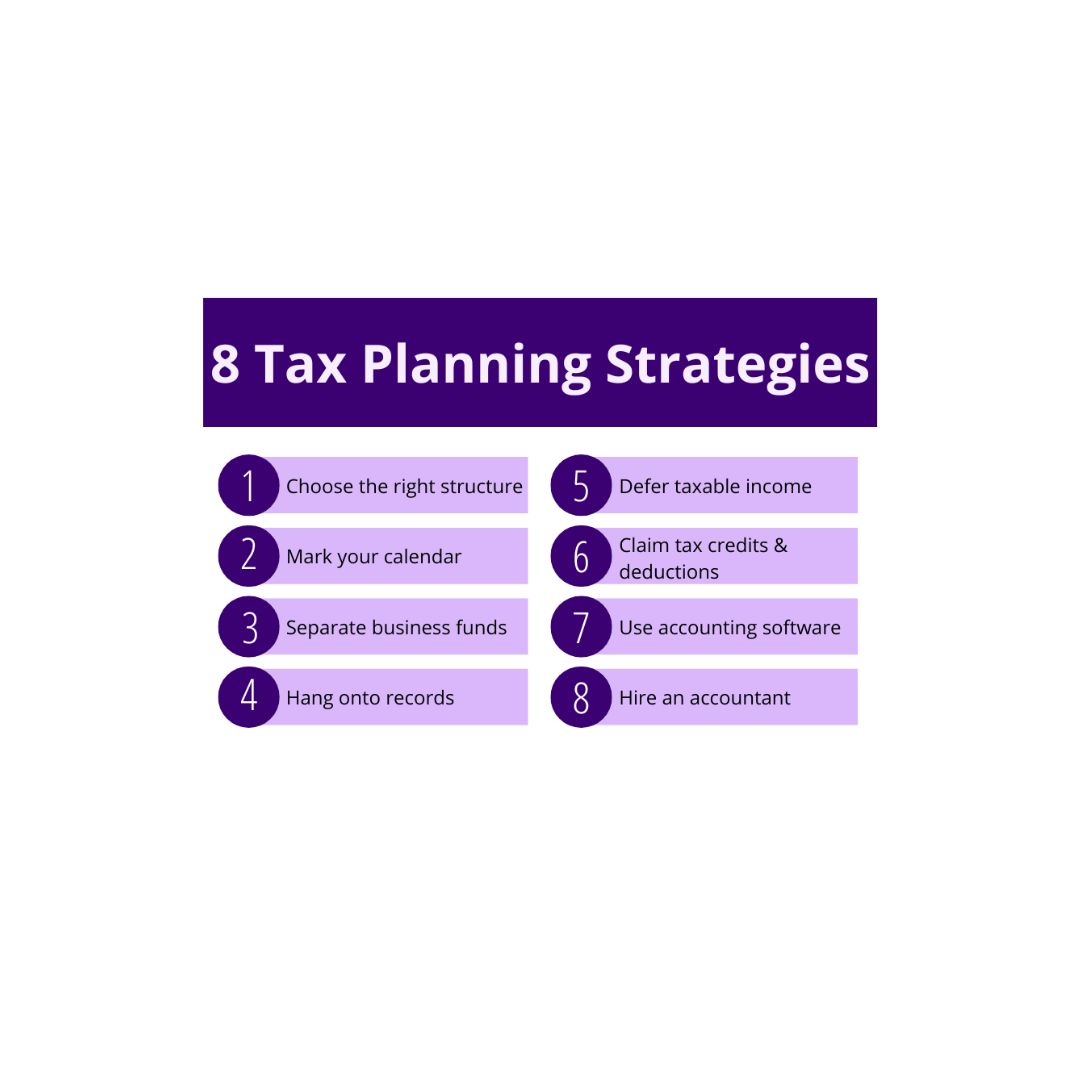

What are tax planning strategies?

Tax planning strategies Tax planning strategies involve various techniques and approaches to legally minimize tax liabilities and optimize a taxpayer’s financial situation. Here are some common tax planning strategies: Income Deferral: Delaying the receipt of income to a later tax year, such as deferring bonuses or income from investments, can help lower your taxable income… Read More »

How to do GST compliance?

GST compliance GST compliance pertains to the act of conforming to the guidelines, statutes, and responsibilities established by the Goods and Services Tax (GST) framework implemented within a specific nation It involves fulfilling various legal requirements and obligations related to the registration, filing, payment, and reporting of GST. Key aspects of GST compliance include: GST… Read More »

Why is TDS required?

Requirement of Tax Deducted at Source Requirement of Tax Deducted at Source, TDS (Tax Deducted at Source) is require for several reasons: Revenue Collection: TDS is a mechanism employe by tax authorities to collect tax revenue throughout the financial year rather than relying solely on tax payments at the end of the year. It… Read More »