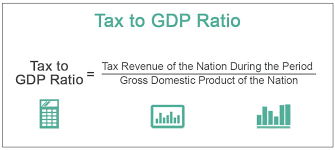

Is income tax included in the GDP?

Is income tax included in the GDP No, income tax does not consider in the calculation of Gross Domestic Product (GDP). Income tax included in the GDP quantifies the total value of goods and services generated within a country’s boundaries over a defined time frame, typically a year. Income tax a tax levy on the… Read More »