Relationship between QA and CA: What is the relationship between quick assets and current liabilities?

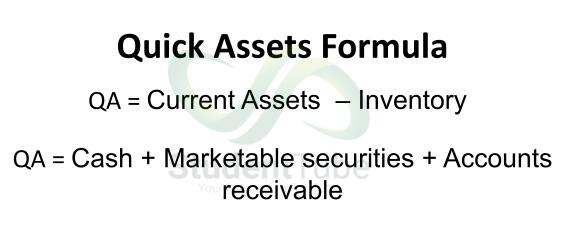

Relationship between QA and CA Quick assets are those current assets that can be easily converted into cash, such as cash, marketable securities, and accounts receivables. Current liabilities, on the other hand, are those obligations that are due within one year. Such as accounts payable, short-term loans, and accrued expenses. The relationship between quick assets… Read More »