What is gst compliant invoice?

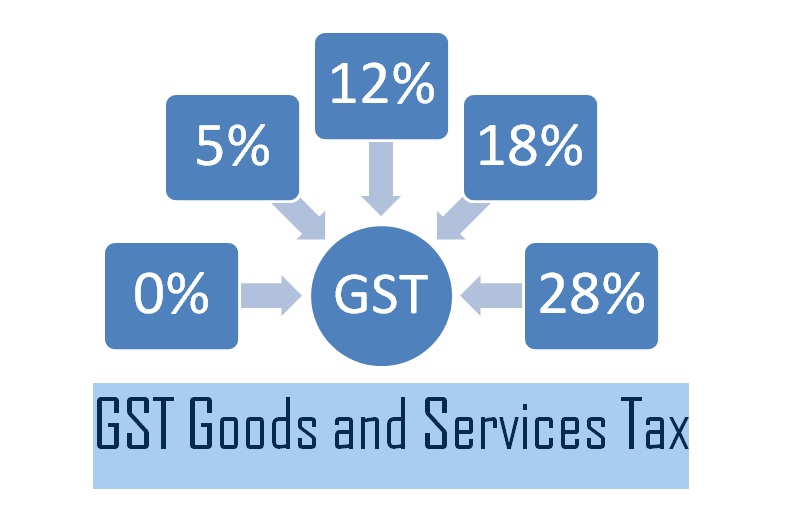

GST Compliant Invoice What is a GST-Compliant Invoice? Introduction The Goods and Services Tax (GST) has transformed the taxation system in numerous countries, including India. It simplifies tax structures by integrating various indirect taxes into a single system. A critical component of GST is a GST-compliant invoice, which serves as a legal document for transactions… Read More »