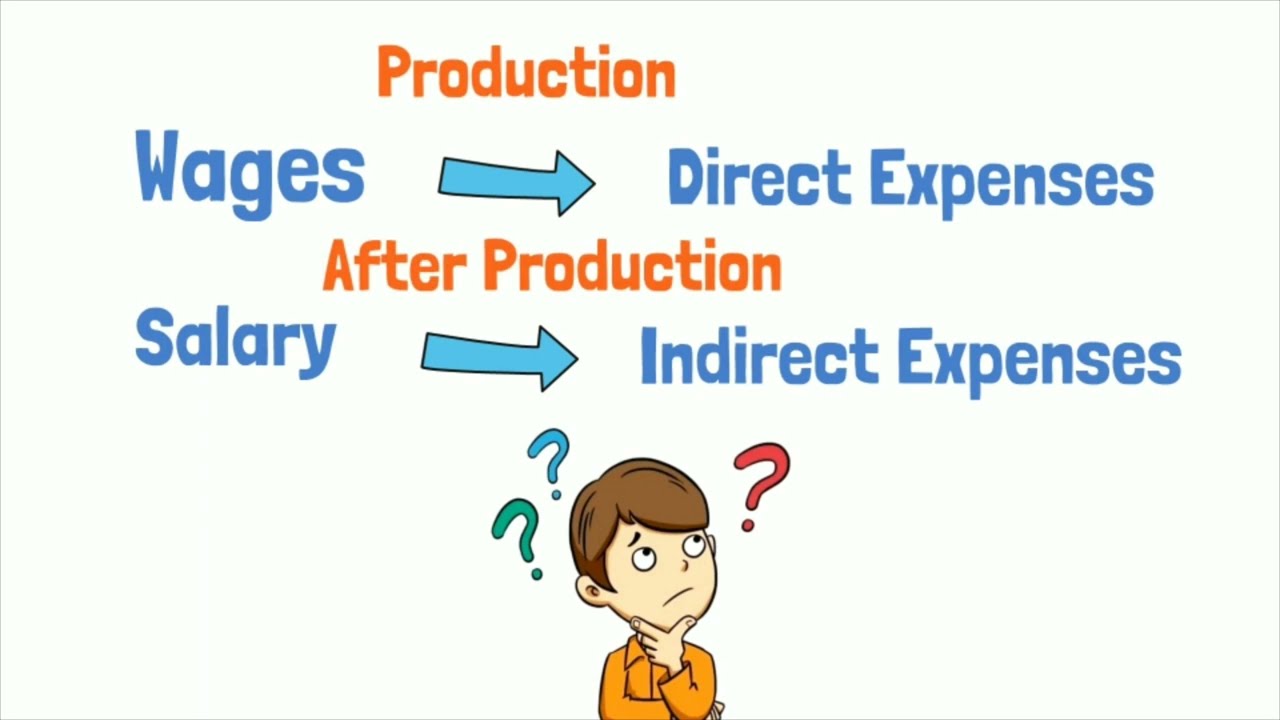

Why are salaries indirect expenses and wages are direct expenses?

Direct and Indirect Expenses Before diving into the specifics of salaries and wages, it’s essential to understand the basic definitions of direct and indirect expenses: Direct Expenses: These are expenses that can be specifically linked to the creation of goods or the provision of services. They vary depending on the level of production. In other… Read More »