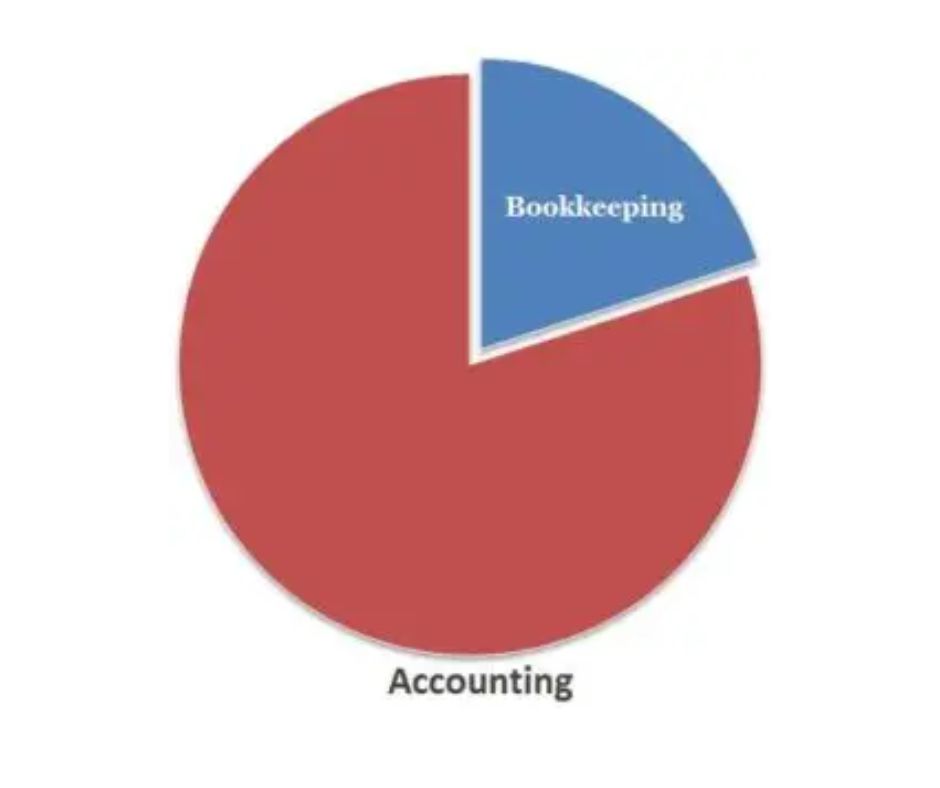

Q10.39 Book keeping and accounting meaning ?

Book keeping and accounting meaning Website link Book keeping and accounting meaning Bookkeeping and accounting are two closely related concepts that involve the recording, organizing, and reporting of financial transactions and information for a business or organization. While they are interconnected, they have distinct meanings: Bookkeeping: Bookkeeping refers to the process of recording and maintaining… Read More »