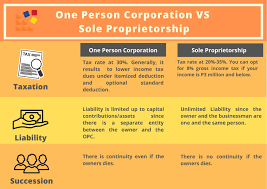

Sole proprietorship vs. OPC?

Sole proprietorship vs OPC Here are the notable distinctions between an OPC (One Person Company) and a sole proprietorship: Legal Structure: OPC: An OPC is a legally recognized entity that is registered under the Companies Act. An OPC (One Person Company) is recognized as an independent legal entity distinct from its owner. Sole Proprietorship: A… Read More »