What is one person company?

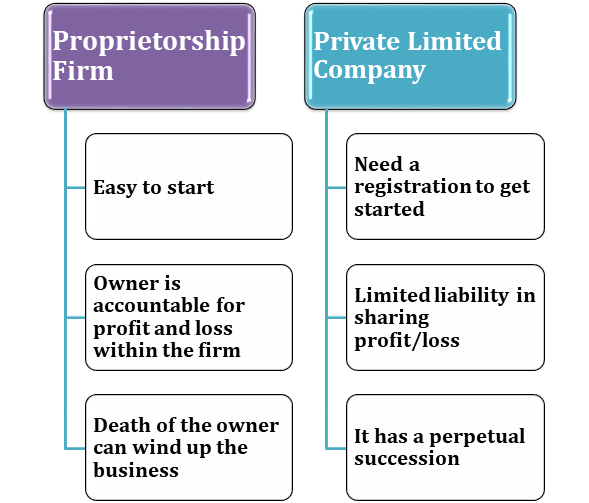

One Person Company One Person Company (OPC) is a type of company that can be formed with only one person as its member or shareholder. It introduce in the Companies Act, 2013 to encourage small business owners and entrepreneurs to start their own companies with limited liability protection. A OPC has a separate legal identity… Read More »