Is the requirement of an original invoice under GST mandatory?

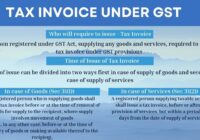

Is the Requirement of an Original Invoice Under GST Mandatory? The Goods and Services Tax (GST) regime has introduced a comprehensive system of taxation in India, aiming to simplify and streamline tax compliance for businesses. One of the crucial aspects of GST compliance is the requirement for invoices. A common query among businesses is whether… Read More »