Valuation of assets for Estate tax Purposes?

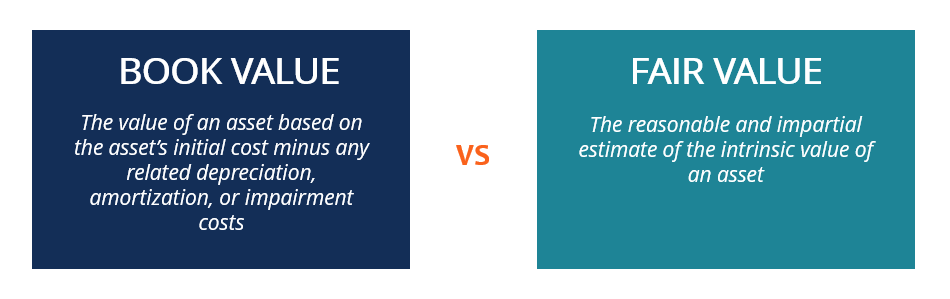

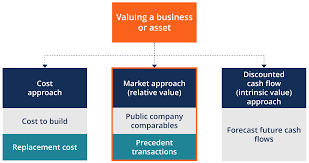

Estate Tax Valuation Valuation of assets for estate tax purposes is an important step in determining the estate tax liability when an individual passes away. The value of assets included in the decedent’s estate is used to calculate the estate tax owed to the government. Here are some key points regarding the valuation of… Read More »